Macro Conditions are Undeniably Bullish

Inflation cooling, rate cuts, tax and deregulation policy tailwinds along with the Age of AI is going to lead to a massive market melt up

Recap

✅ AMD was a great pick—will be happy to add more on any future pullbacks towards $200 price target.

❓ My forecast since May was that we should see some volatility as we head towards July with the early July trade deal deadlines and the bill facing challenges either in Congress or the Senate around this time—that volatility and government shutdown situation didn’t materialize.

❌ What I was not able to anticipate was just how bullish this market was and we hit all time highs just this past week, sooner than I thought we would. It was wild to see how there was barely any dip and negative news from the Israel-Iran conflict which also didn’t lead to higher oil prices.

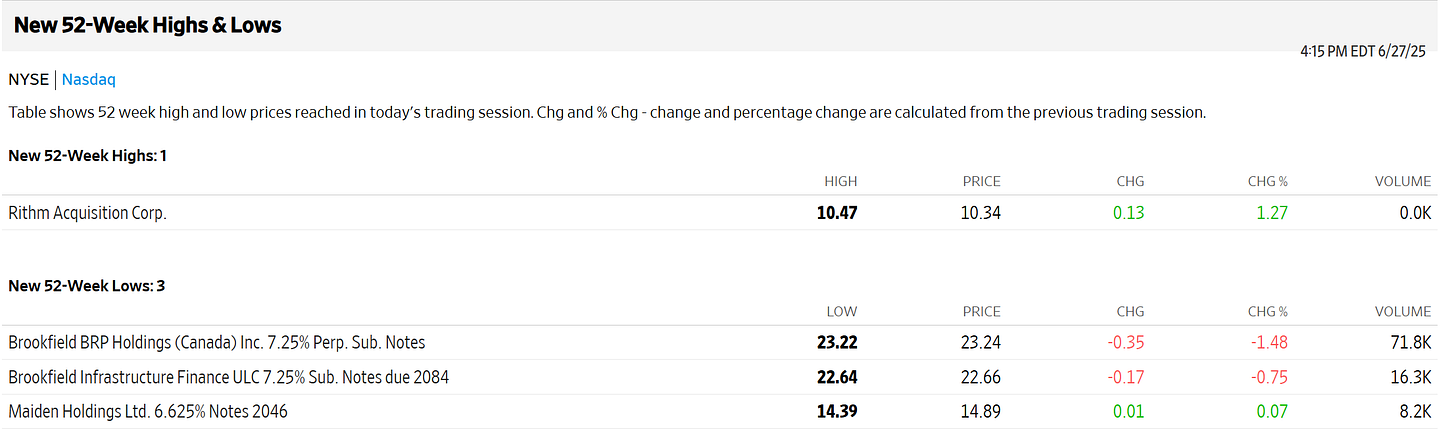

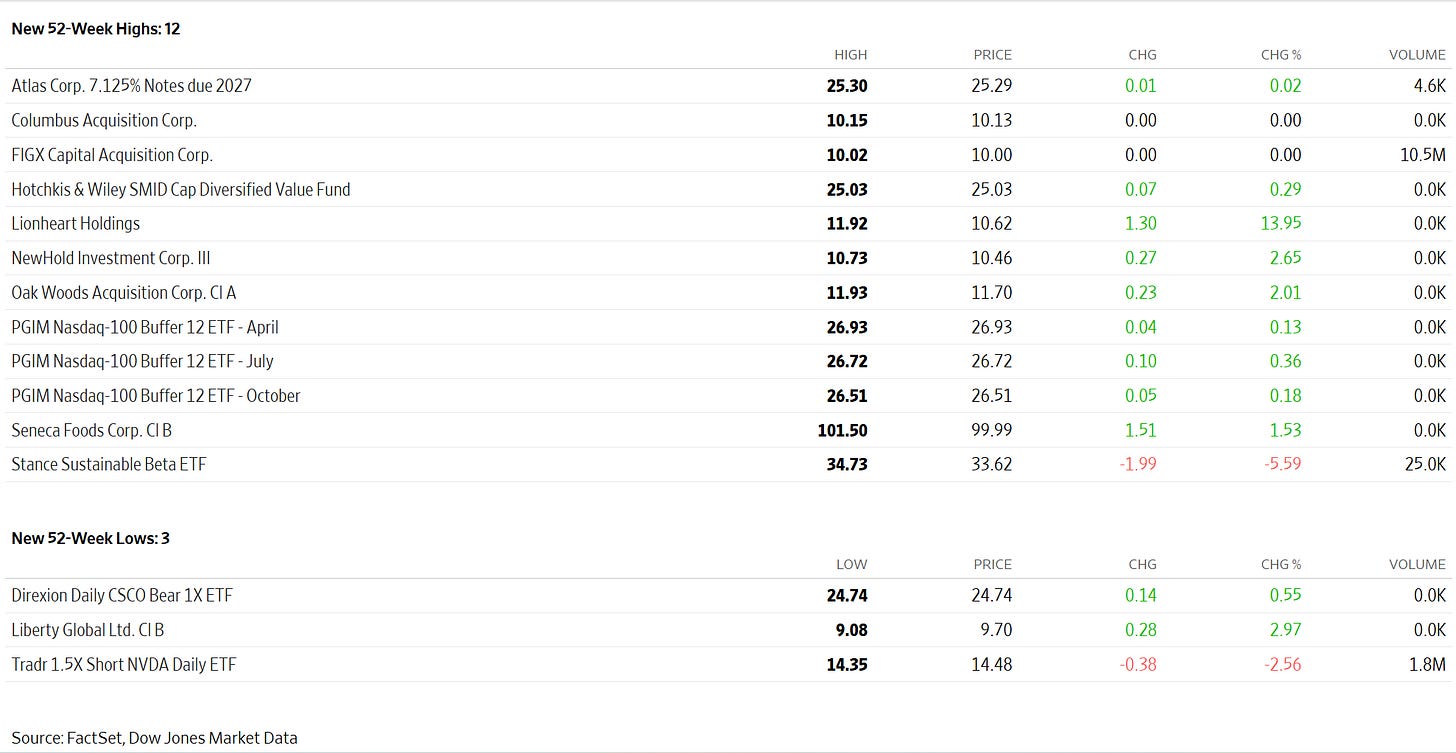

New 52-Week Highs vs New 52-Week Lows

NYSE New 52-Week Highs: 1 vs New 52-Week Lows: 3

Nasdaq New 52-Week Highs: 12 vs New 52-Week Lows: 3

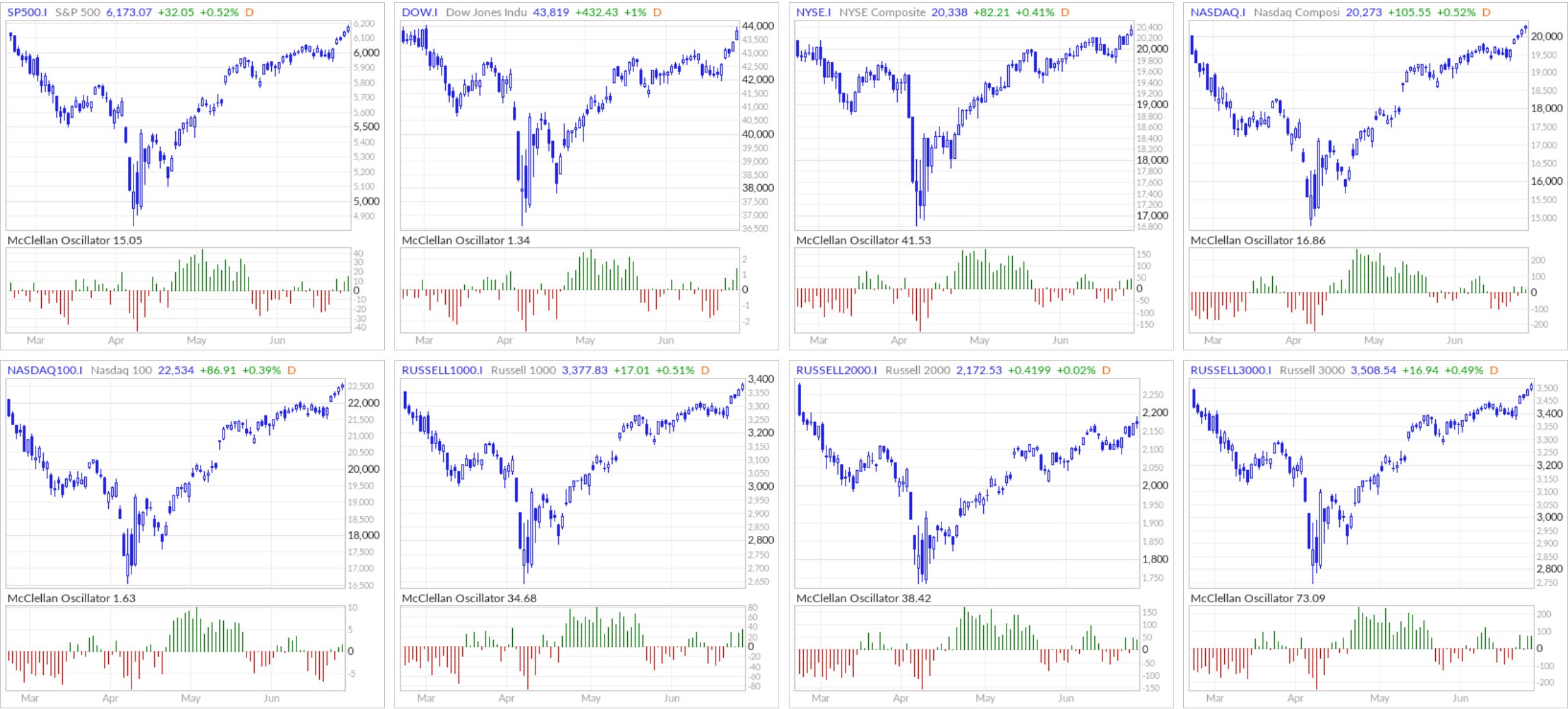

McClellan Oscillator is not in over-extended levels yet

McClellan Volume Summation Index saw a very bullish new high for most indices

*This my personal blog and is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.

Posts of Interest

IWM saw another weekly close above 212—this is quite bullish going forward.

Dow Jones US Semiconductors Index breaking out

Dow Jones US Software Index breaking out

Forecast: Melt Up Is Coming

The market returned to Greed and will retest Extreme Greed—whatever dip from the bill or trade/tariffs “deals or delay or no deals” will be dips to buy as the market continues making new ATHs.

Macro conditions are turning undeniably bullish.

Inflation is cooling: core inflation is continuing its downward trend across key categories. I’s a trend that has given the Fed cover to shift its stance. Sticky components like shelter and services are easing, while goods inflation remains subdued.

Rate Cuts are getting priced in: The Federal Reserve has clearly telegraphed rate cuts, and the market isn’t waiting. Equities are front-running this policy shift, pricing in looser financial conditions that will support growth, risk assets, and corporate earnings.

Policy tailwinds are lining up: Sources suggest Bessent is laying the groundwork for a pro-growth policy push starting with a tax leg followed by targeted deregulation. These moves could unlock fresh capital, spur corporate investment, and fuel risk appetite in a market already hungry for yield and momentum.

We are no longer in a climb the wall of worry phase and entering a potential melt-up where momentum, liquidity, and policy align to drive the market even higher. Every dip becomes an opportunity.

SPX 10,000 is my target by 2026.

AAII sentiment continues to still be too bearish and bullish levels has not reached 40% yet.

GitLab, Agents, and the Next Era of Software Development

Insights from GitLab CEO Bill Staples on AI and developer tools

Keep reading with a 7-day free trial

Subscribe to Best of Twitter/Threads, Analysis & Forecasts to keep reading this post and get 7 days of free access to the full post archives.