Bullish Market Rotation and Greed Came Back

Facebook, Google, Microsoft has poorer than expected earnings

Contents

Today

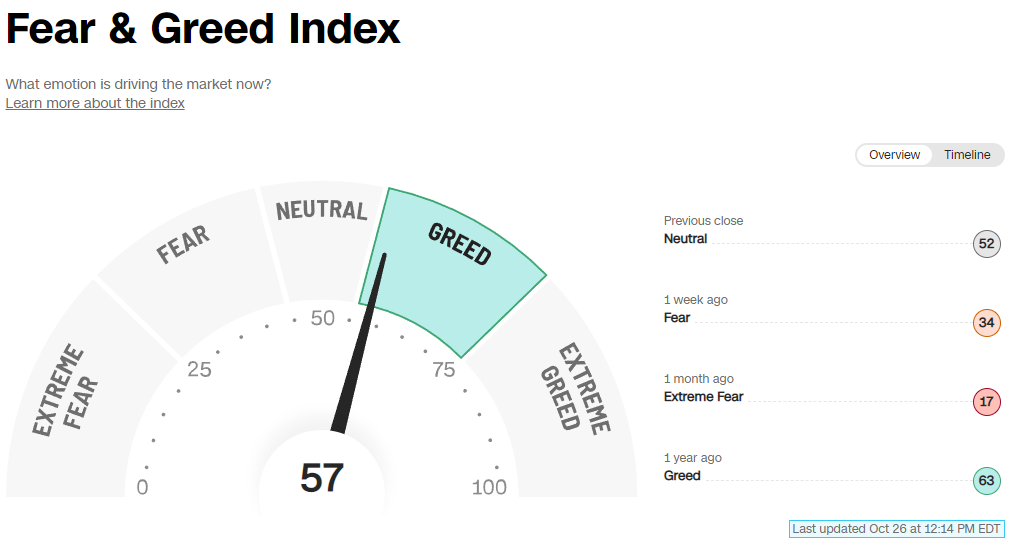

Fear & Greed Index is finally back to Greed levels

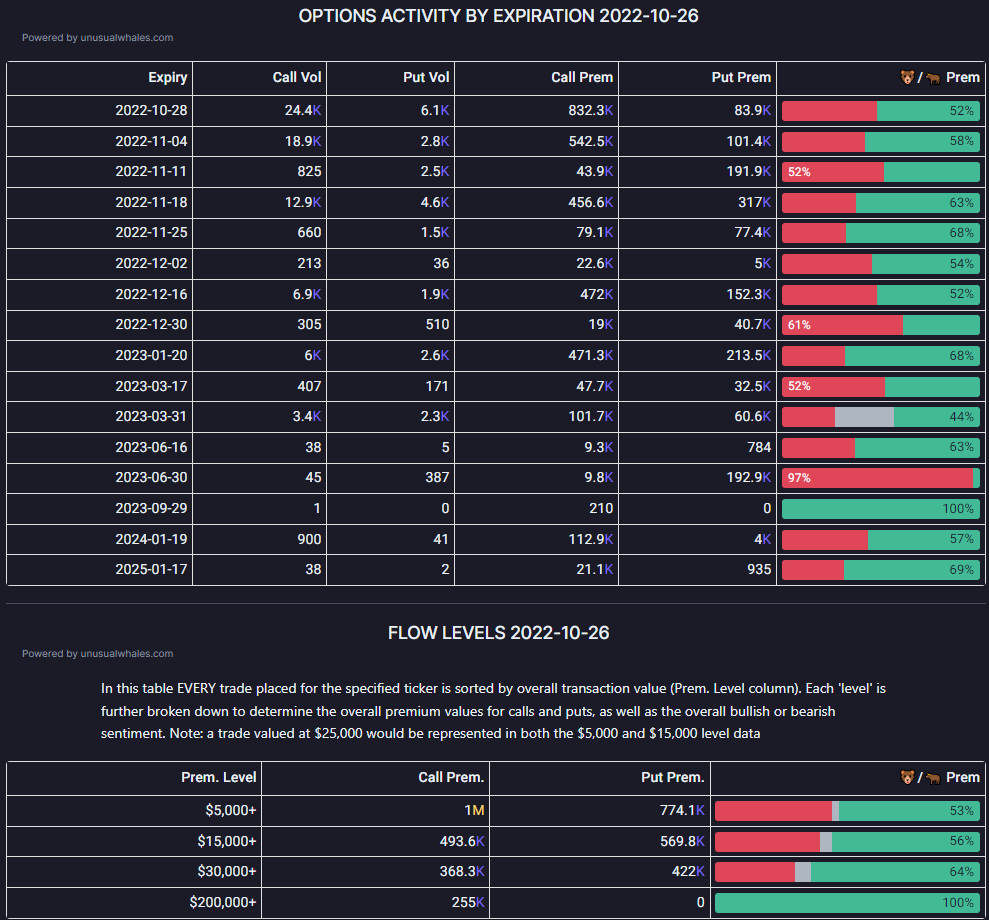

Gamma Exposure stayed at +$1.55B, which is surprising given the poorer than expected earnings from Microsoft and Google. With the other sectors such as the Dow Jones Industrial Average DIA 0.00%↑ to finance, energy, solar, etc. sectors, I think the market is simply rotating to sectors that seem to be doing better than expected.

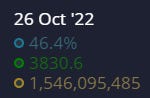

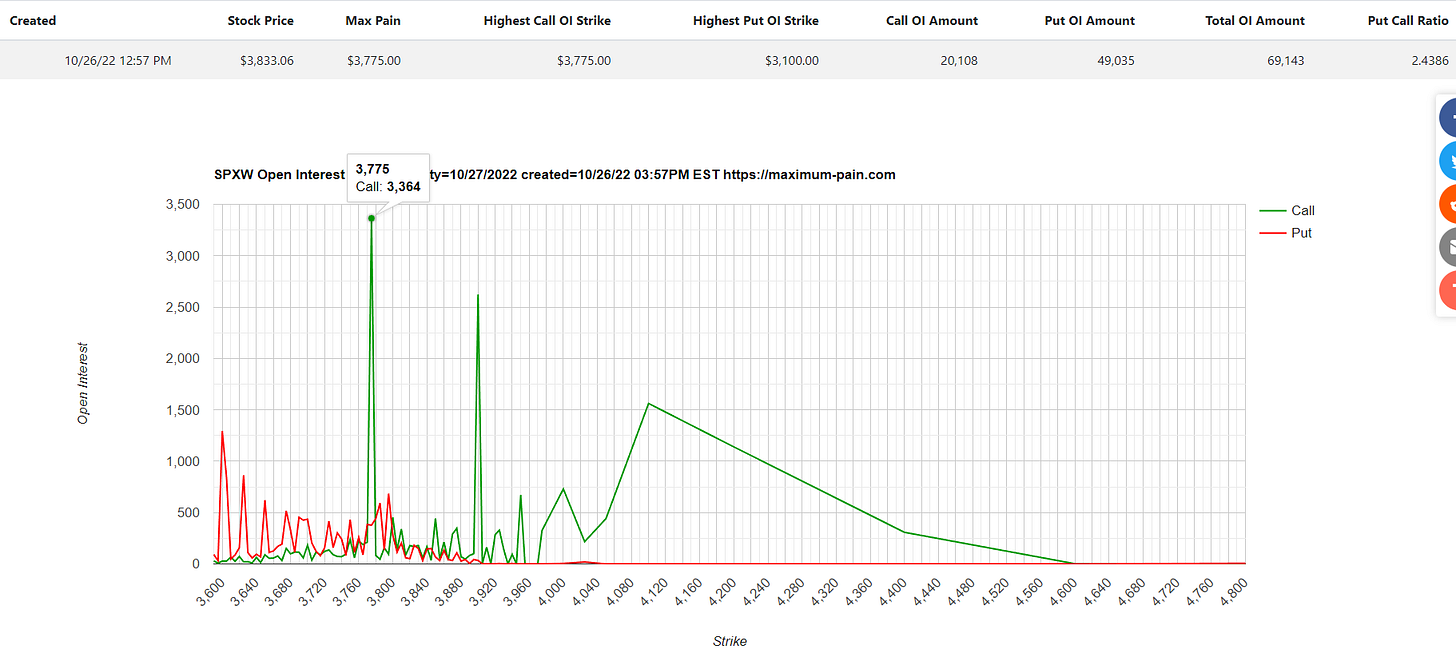

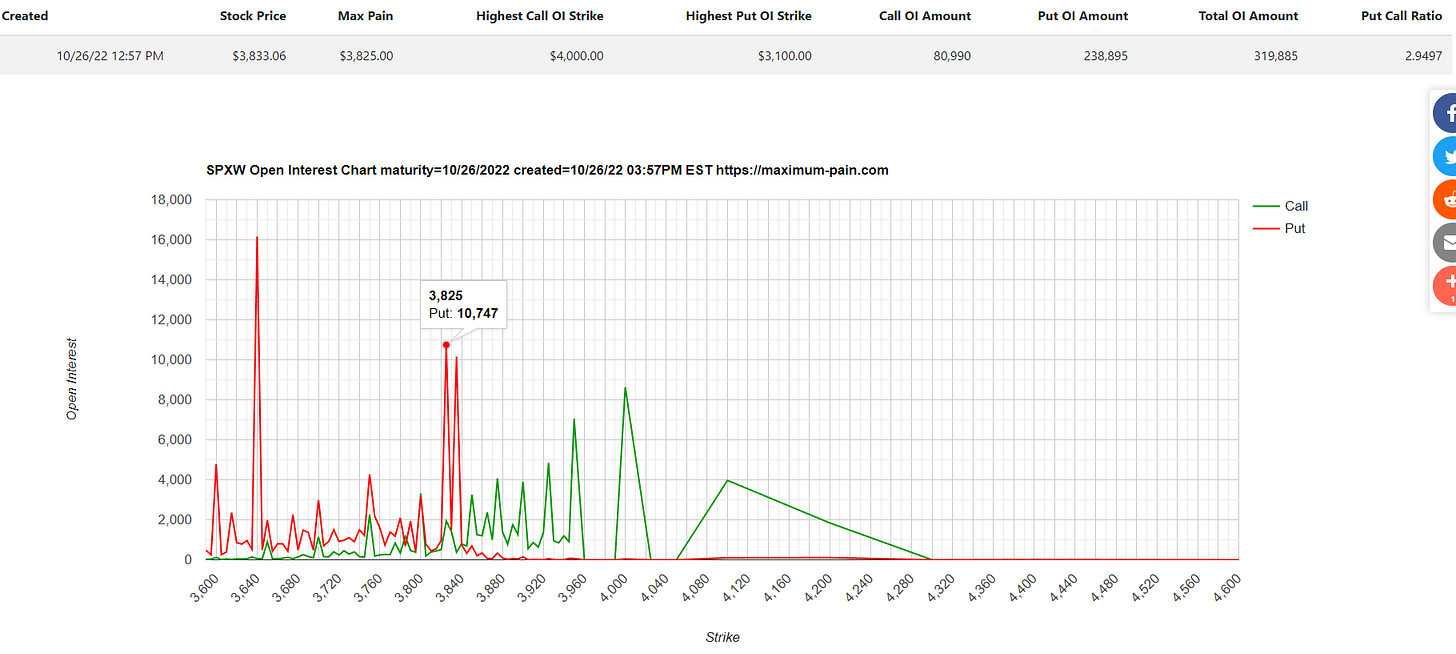

Flows are still bullish because the market closed above max pain of 3825

Market Rotation: Non-Tech Sectors are Bullish

Although SPY 0.00%↑ ended the day -0.74% and Nasdaq -2.04%, I saw a lot of bullish flows to other sectors—this will give the bear market rally more legs to go on further and tech has been the strongest leading sector of the past bull market.

This is why I have been sharing that we would not likely see the market revisit Oct lows because flows are strong in many other sectors of the market. Sector outperformers were Energy XLE 0.00%↑ and Healthcare XLV 0.00%↑ . Even Utilities XLU 0.00%↑ and Real Estate XLRE 0.00%↑ stocks saw modest gains.

The Dow is already and will likely continue to outperform the Nasdaq.

My thesis on shorting tech and longing these other sectors has worked out ✅.

Tomorrow

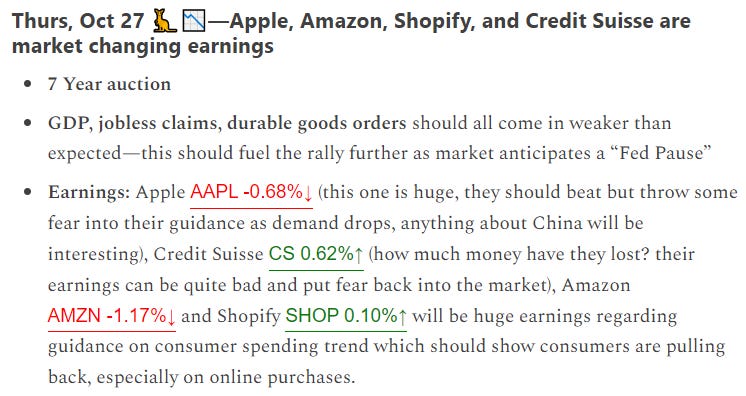

SPXW max pain Thurs is 3775—this can again change more bullish once we open and flows update during the day. If Apple and Amazon earnings are ok and not horrible, I can see the market closing around SPX 3900 as it retests the daily MA100.

All eyes are on Apple and Amazon tomorrow—I have a feeling Apple will have the best earnings out of the megacaps and Amazon should report weak results similar to Microsoft and Google but not as bad as Facebook.

I will continue holding my longs and swinging them on any pullbacks: T 0.00%↑ , V 0.00%↑ , DFS 0.00%↑ , RTX 0.00%↑ , ENPH 0.00%↑ , ARRY 0.00%↑ , XLU 0.00%↑ , TAN 0.00%↑ , OXY 0.00%↑ , XLE 0.00%↑ , XLV 0.00%↑ . Notice, I am avoiding tech completely.

I will be looking to re-enter shorts BYND 0.00%↑ , CVNA 0.00%↑ once their short squeeze rally tops out.

Notice the meme and crap stocks saw another day of short covering today—I do not push shorts when the crappiest stocks squeeze upwards. It means the market is going higher and the shorts realize they can’t push price any lower and decide to cover their positions.

Here’s my thoughts from Sunday’s Weekend Analysis 👇

Crypto

Bitcoin broke out of it’s declining trendline and is now holding $20k. Based on technical analysis and options flow below, it looks like a retest to $23k will happen soon.

Bitcoin daily chart

Bitcoin ETF BITO 0.00%↑ has pretty bullish call flows throughout (see bullish premiums or the green bars below).

BITO options flow

Insightful Tweets

Many tech companies are not reporting good results

PCE Price index is this Fri and it might surprise to the upside 🚨

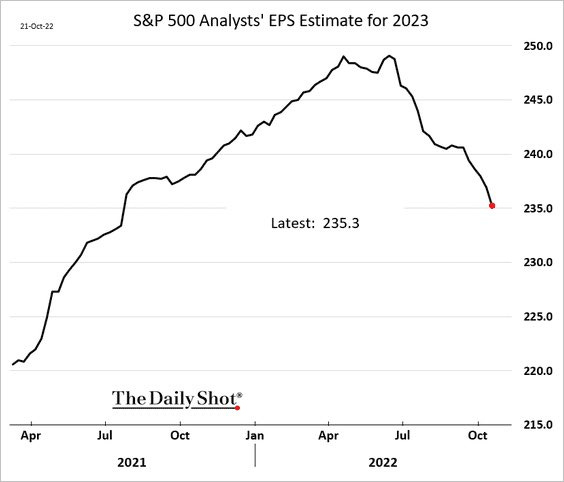

S&P 500 earnings estimates for 2023 on a declining trend

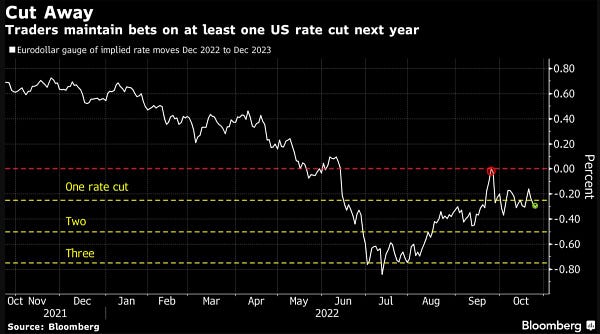

No evidence to support a rate cut but the market is trying to price it in anyway

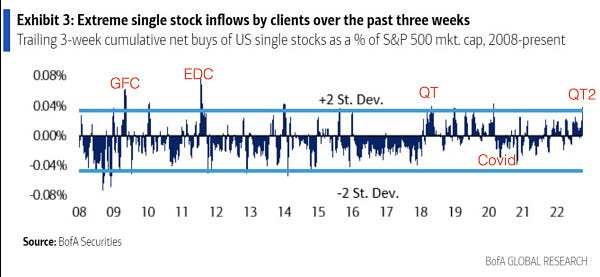

Flows are dominating price action, so the market wants to go higher as funds want to end the year strong

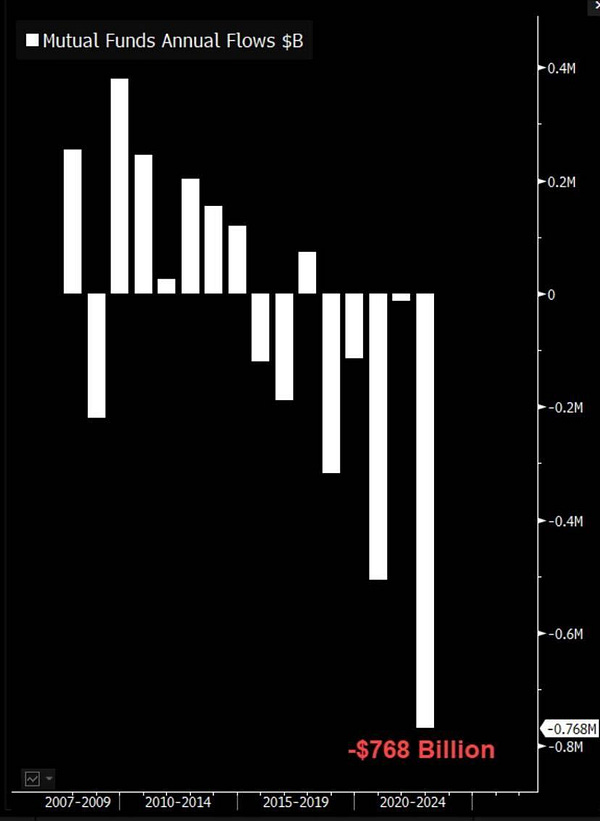

This is a wild stat: wonder if it’ll continue going into 2023 and looming recession

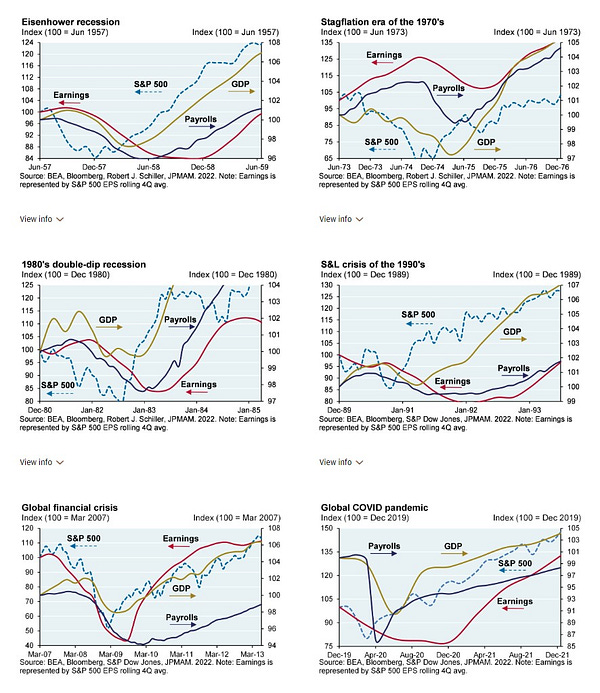

Stocks tend to bottom long before economy does, so good to keep in mind if this is a cyclical or secular bear market (two big differences)

*This is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.