Why the Fed is Staying Tight Longer (Short-term Bearish, Long-term Bullish)

CPI cooler but market couldn't break out yet, CPI base effects

It has always taken economic pain to bring down high inflation and a runaway bull market loosening financial conditions would undo a lot of the work the Fed has done so far.

This article below (link HERE) was a great read by James Bullard (St. Louis Fed Chief) and shows the Fed has institutionalized the lessons of previous fights against high inflation. And why in tomorrow’s FOMC meeting, the Fed will not ease early as the market is trying to anticipate and price in rate cuts in mid-2023.

The takeaways

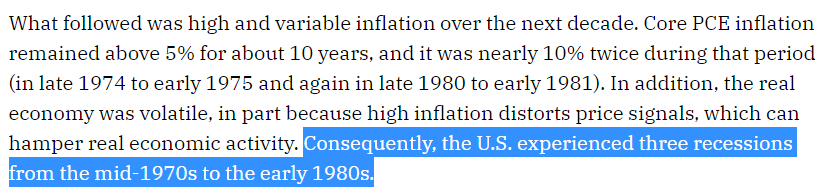

The Fed easing prematurely or staying loose despite high inflation in 1974 lead to inflation roaring back and 3 recessions

The Fed achieving price stability and staying ahead of inflation (staying tight) in 1983 and 1994 led to economic growth and avoided recession

In 1983 and 1994, the FOMC kept the policy rate relatively high above the inflation rate, and therefore real interest rates were relatively high. The subsequent macroeconomic performance—with respect both to inflation and to output and labor markets—was very good, which shows the merits of staying ahead of inflation as opposed to falling behind.

Price stability is the bedrock of sound economic growth. As the Fed has repeated many times, history has taught us when the Fed eased prematurely then “the real economy was volatile, in part because high inflation distorts price signals, which can hamper real economic activity.”

Easing prematurely and allowing inflation to roar its ugly head back like it did in the 1970s gave us “high and variable inflation” (instability in prices) and will lead to rolling recessions which hurt growth for the next decade.

Therefore, if the Fed stays the course against inflation, even against higher unemployment, I would go long any panic sell offs or recession fears in 2023 because the recession might not materialize as we saw in 1983 and 1994 (this time could be different regarding our debt levels and leverage across non-bank entities). Regardless, if it’s a financial crisis, mild to severe recession, to soft landing, I would go long during 2023.

So ‘counter-intuitively’, I’m bullish if the Fed stays the tightening course into most of 2023. I forecasted that they would stay tight even through a downturn eliminating the “Fed put”. And I have been bearish short term because I don’t think the market has priced this in yet. But once it is priced in (SPX 3,000-3,200) I will be bullish as the Fed is truly committed to price stability vs high & variable inflation. It would simply be unwise to continue being bearish given the history.

What the Fed is doing is working, they took a huge risk jacking interest rates up so fast but didn’t break anything. Honestly, the economy seemed to be handling it better than expected. And as I shared before, the Fed has much more institutionalized knowledge—this is the most capable Fed we have ever seen. How Powell navigated the COVID crash and pulled us out of recession so quickly is evidence of this.

The market reaction will be negative to the Fed staying tight through most of 2023, but 2023 might be a great opportunity to go long if you trust and believe in this “well equipped and capable Fed” thesis.

Powell emphasizes high inflation’s impact on poor and working Americans

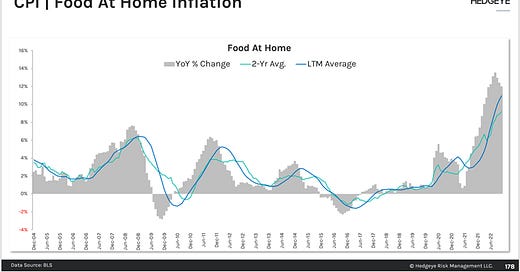

In almost every one of Powell’s and the Fed Chiefs’ speeches, they emphasize the pain of inflation on the working class and poor Americans—who inflation harms the most. They cannot ease when high inflation is clearly not beaten. Food to shelter prices are still elevated so the Fed has more work to allow their tight monetary policy make its way to food and shelter.

EVERYTHING has to come down to show inflation is not rotating to other areas of the economy—wages, services, or workers to businesses psychology.

He has to stay tighter for longer than the market expects. The cooler than expected CPI is now shifting towards fear of deflation and recession and the Fed will stoke these fears because they will stay the tightening course. Earnings will get worse next quarter as rates rise towards “sufficiently restrictive.”

But that is the “cost” of price stability—we need lower growth and more slack in the labor market to drive wage growth down so inflation stays grounded towards 2% not 6-7%. We simply won’t be able to achieve price stability if wage growth is around 6-8%.

Biden couldn’t put it more perfectly…wages have increased faster than prices (lol 😆 this wage growth isn’t good for inflation long-term as it’s much stickier).

Higher Rates Encourages More Saving vs Spending

Inflation is still far too high and although US is seeing improvement in CPI lately, that isn’t the case for many other countries. Now you add China reopening up increasing the global demand for commodities and energy.

The cooler CPI reports, that means future CPI reports can surprise to the upside against a weaker US dollar and higher energy prices.

November 2020-2021 CPI

November 2021-2022 CPI

Oil usually tops before we then enter into a recession. So far the economy is still too strong and unemployment is low, wage growth is continuing at ~6% so demand will remain strong, especially for oil.

The Fed simply CANNOT prematurely ease and why I am now short going into the Dec FOMC

Europe to UK to New Zealand are all hiking more than the US is going forward—this means a weaker US dollar = inflation risks to the upside heading into 2023

Inflation is rotating into wage growth and this is a major problem and why the Fed must stay the course

Inflation pressure remains elevated (but it is improving): PPI leads CPI, so if PPI is higher than expected it eventually will bleed into future CPI readings. The Fed knows this, so although today’s CPI report was welcome, the PPI to wage growth inflation are not as good.

This Fed has to stay tight for much longer to avoid this 👇 kind of bullshit of “high & variable inflation” of the 1970s (this dude is also not putting into context Fed monetary policy in the 1970s…he obviously didn’t read Bullard’s article LOL 😂)

Today

SPX rejected 4100 clearly then failed at 4045—the monthly EMA13, I then reloaded on my short positions against tech and swinging long OXY and oil (again but with tighter stops) while also staying long TLT. The Dec FOMC should send the DXY higher again.

Like the PPI report, why didn’t the market continue to rally and confirm the breakout? You got a COOLER than expected CPI report and PPI that’s lower than previous. What else is needed to push us to a breakout….the Fed 😉. This is why Druckenmiller says to follow and listen closely to the Fed.

ESPECIALLY with such a cool CPI report, the market should’ve easily broke out but instead it registered a DeMark 13 sell 👇

Here’s my reasoning:

Inflation is still far too high: Tech/growth won’t do well just yet in a higher interest rate environment that’s continuing to rise. See below on my comparison of Nov 2021 vs Nov 2022 CPI, we are still celebrating 7%+ inflation? This is on top of the ~7% CPI back in Nov 2021. 7% YoY on top 7% YoY is nowhere near price stability. Yes peak inflation is behind us but such high inflation means the terminal rate needs to get towards 6% then once inflation drops below 6% we can slowly cut rates to ensure the inflation beast is defeated. The Bank of New Zealand straight up bluntly said they want a recession to kill inflation.

Unemployment is just starting to increase: unemployment is what reflects a growing or contracting economy and based on most of the data, the economy is contracting. The labor market is still strong and consumers will continue to spend until they don’t. We simply don’t have enough unemployment to cause oil demand to collapse and with oil reversing as I called yesterday, that bodes poorly for the fight against inflation. The economy and wage growth are both still strong and people are still spending which leads to demand continuing vs collapsing. Tech and growth stocks will be great to go long once we reach max fear and peak % change in unemployment as that is when recessions bottom out and returns to growth.

China is reopening: they will increase demand for oil and commodities—causing inflation to rear its head back

DXY declining is now bearish because of inflation: a weaker dollar increases inflation risks, the Fed wants a stronger US dollar as that has shielded the US from inflation since most commodities and oil are priced in US dollars.

Gamma exposure increased with that rally but DIX (blue line) dropped and made a lower low to 44.5%—anything below 50% is usually seen as bearish in the dark pools.

New 52-Week Highs vs Lows

I like checking the WSJ’s new 52 week highs vs 52 week lows link HERE to get a feel of market rotation:

NYSE: new 52-week highs 91 and new 52-week lows 56

NASDAQ: new 52-week highs 131 and new 52-week lows 251

I wouldn’t be long Nasdaq given more companies in the Nasdaq index made new lows today into a cooler CPI print! And as I shared, the charts for XLC 0.00%↑ , etc. look horrible

A decent amount of the 52 week highs were Chinese companies but I see consumer staples to healthcare making new highs—sectors I said in my Weekend Analysis—The Age of Defense & Value would continue to do well in this macro environment:

52 week highs: Pepsi Co PEP 0.00%↑ , Cigna Corp CI 0.00%↑ , Gilead Sciences GILD 0.00%↑ to Cintas Corp. CTAS 0.00%↑ (they make work uniforms) to Pinduoduo PDD 0.00%↑ , Dicks Sporting Goods Inc. DKS 0.00%↑

52 week lows: Coinbase COIN 0.00%↑ , Lucid LCID 0.00%↑ , Tesla TSLA 0.00%↑

Options Flow

XLE 0.00%↑ (energy sector) top 250 by premium is bullish volume and premiums. As I pointed out previously, the chart is bullish and bounced off the weekly MA20.

QQQ 0.00%↑ top 250 by premium looks balanced from a the premiums but whale premium C/P is at 77.4% puts

IWM 0.00%↑ is pretty bearish overall—as I pointed out regarding last week’s chart

SPX is also balanced and whale premium C/P is at 52% calls

Based on options flow, I think the sell off will be more pronounced in tech, small caps, and money losing companies—which explains why a lot of the new 52-week lows were tech, small caps and unprofitable companies. The market will continue rotating to the value and defensive sectors. The “old economy” stocks are hot now and “new economy” stocks won’t be during a period of higher interest rates for longer.

Insightful Tweets

Hmmm, as I said, inflation is still too high and risks remain to the upside

The figures will reinforce worries at the Bank of England that a tight labour market is driving wage growth to a level that is incompatible with its 2% inflation target. 👇

We cannot let inflation roar it’s ugly head back so the Fed must stay tight until the job is done. We are still at 7% YoY inflation on top of 7% YoY inflation base effects.

Technical analysis on SPX

Interesting flows to money market accounts? Why not park it in short-term treasuries?

Germany is in big trouble soon…? And the ECB is going to raise rates to encourage saving vs spending, pretty much into a recession.

Taiwan is slowing down significantly too

Out of the Asia countries, India remains resilient and the Indian stock market reflects it

The run on the bank on Binance is concerning, can lead to financial contagion

This is an interesting thread on 2% CPI by July 2023 lol, it assumes earnings drop by a significant amount along with demand—also base effects will help him here

*This is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.