When Macro Starts to Matter, Micro Stops to Matter

There is an upcoming underlying shift in the market

Recap

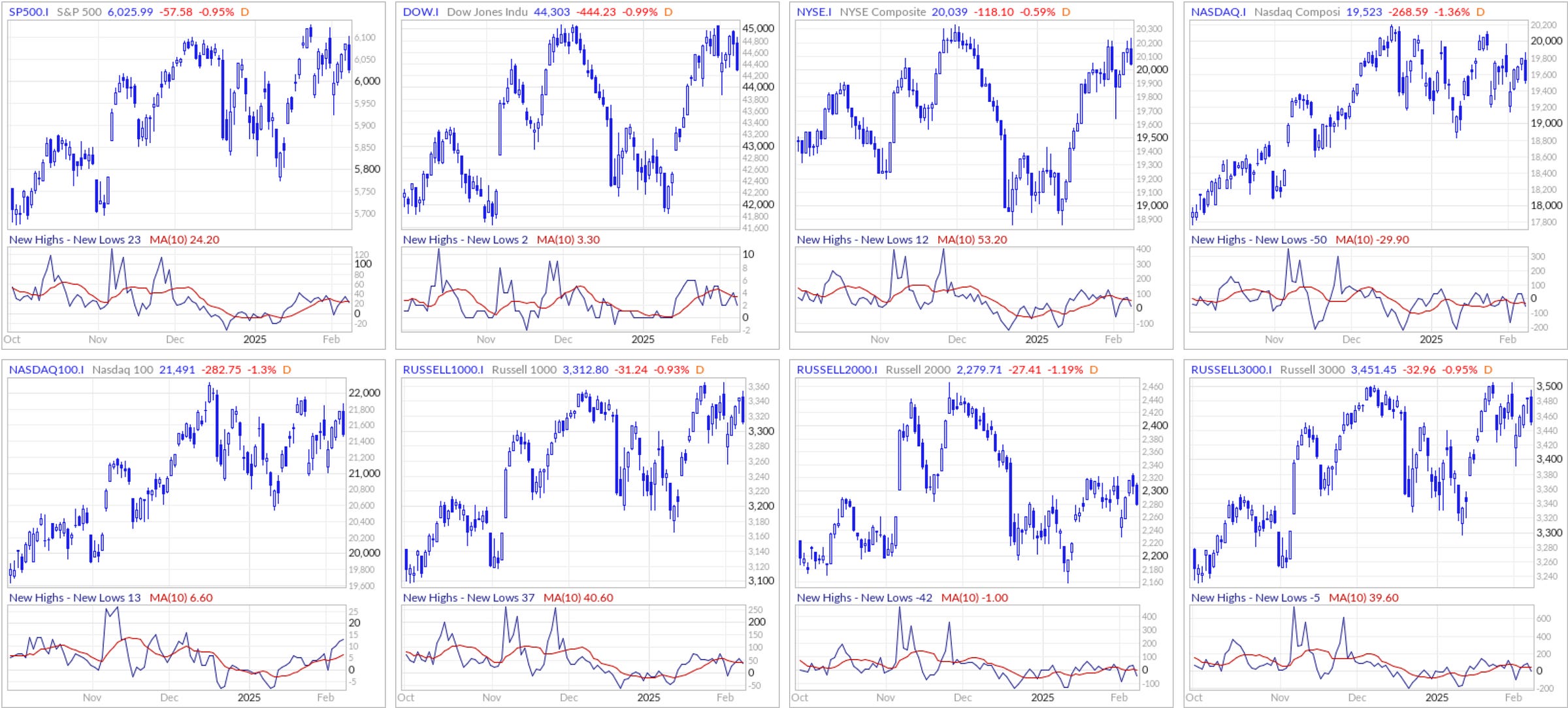

✅ SPX 6100 and SPX failed to get a close back above it to end last week.

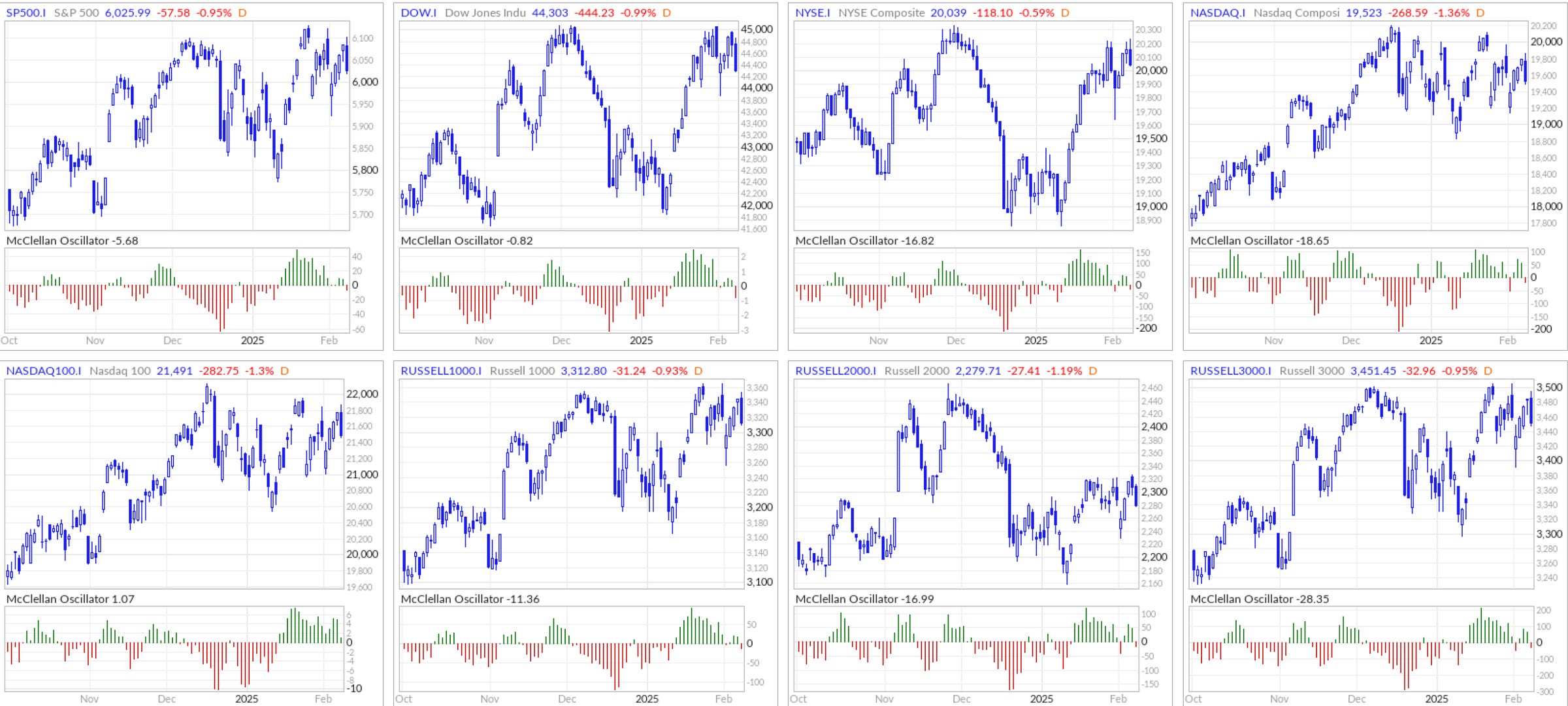

New 52-Week Highs vs New 52-Week Lows

NYSE New 52-Week Highs: 89 vs New 52-Week Lows: 80

Nasdaq New 52-Week Highs: 150 vs New 52-Week Lows: 165

New 52-Week Lows trending higher

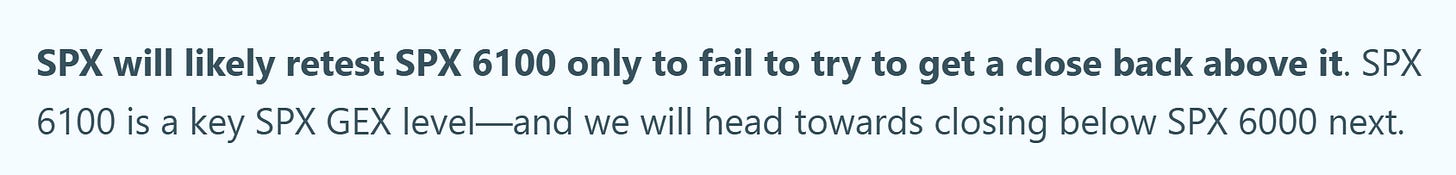

McClellan Oscillator

New Highs - New Lows

How much the Mag7 stocks are able to bounce back will be a solid indicator if we’ll see more volatility.

*This my personal blog and is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.

When Macro Starts to Matter, Micro Stops to Matter

We could see the market shift to macro-level factors becoming more important than micro-level factors (such as company-specific details) in driving market movements.

When larger economic forces like geopolitical events (tariffs, etc.) take center stage, they can overshadow company-specific performance.

As we saw during 2022-2023, even well-managed, profitable companies saw their stock prices fall simply because the overall market is declining due to macroeconomic concerns.

Markets do not tend to do well in periods of macro uncertainty when there are threats of tariffs and retaliation, etc.

The U.S. January nonfarm payrolls (NFP) report showed job growth slowed to 143K, missing expectations of 170K and down from 307K in December. This is not bearish until we start to see a larger negative trend that leads to jobs getting laid off.

Inflation remains a key concern, with headline CPI at 2.9% in December and core CPI at 3.2% YoY—staying sticky above the Fed’s 2% target.

This week we’ll see the latest CPI data, projected at 0.3% MoM and 2.9% YoY, while core inflation is expected to hold at 3.2%—if we get a higher print than expectations then volatility will come right back. Additionally, Donald Trump’s import tariffs against China, Canada, and Mexico could sustain higher inflation, potentially keeping Fed rates elevated. Fed Chair Jerome Powell is also giving a speech this week that can move markets.

Forecast

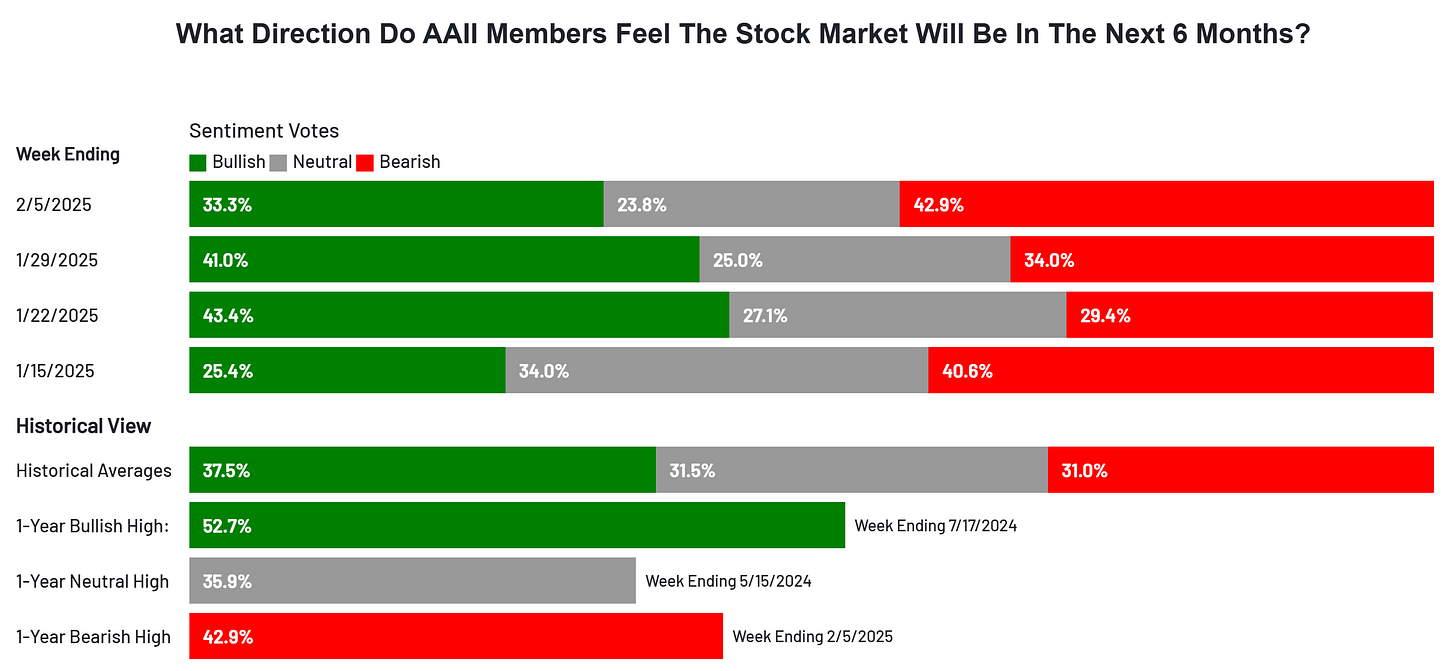

Last week, we saw a new 1-Year Bearish High reading at 42.9%

Keep reading with a 7-day free trial

Subscribe to Best of Twitter/Threads, Analysis & Forecasts to keep reading this post and get 7 days of free access to the full post archives.