Recap

❌ CPI and PPI reports were fine and not bearish.

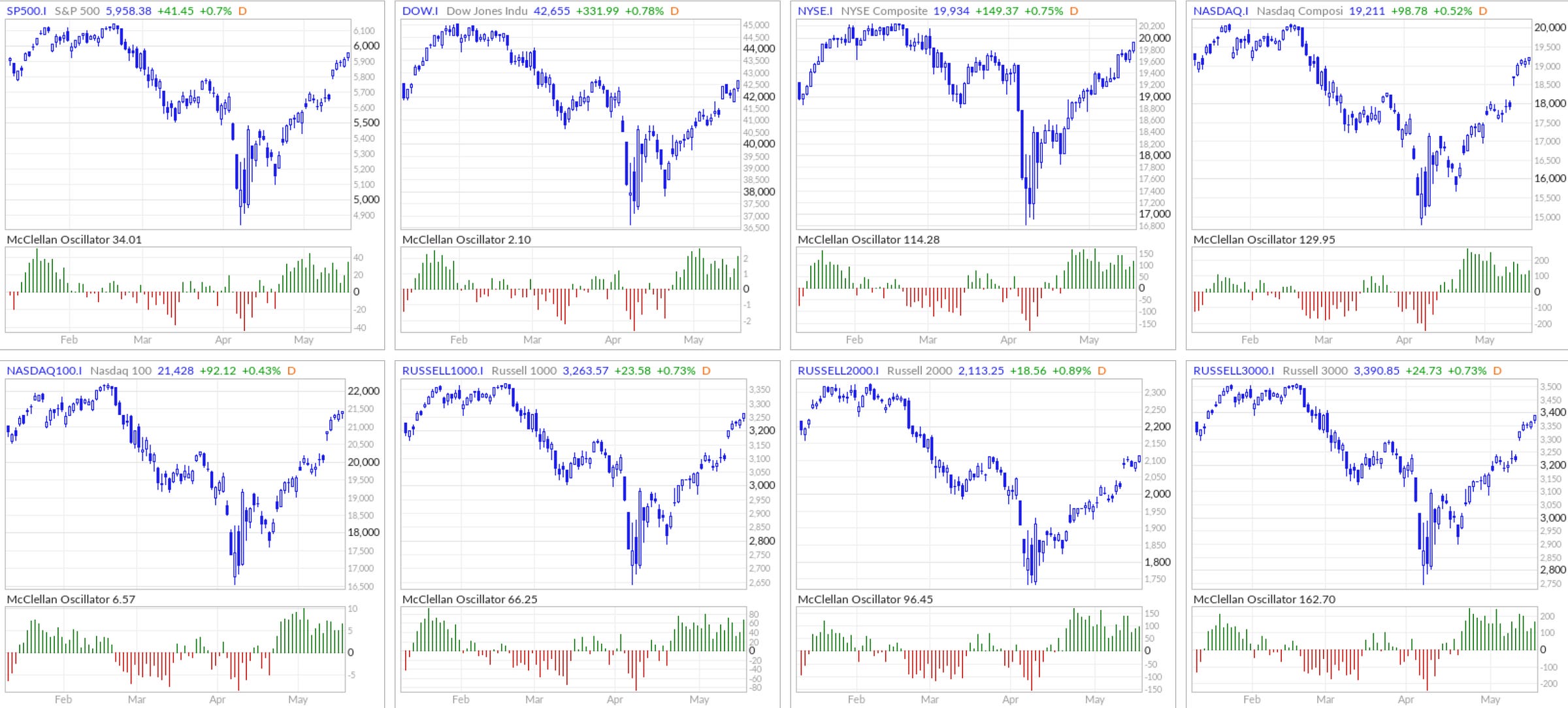

New 52-Week Highs vs New 52-Week Lows

NYSE New 52-Week Highs: 85 vs New 52-Week Lows: 11

Nasdaq New 52-Week Highs: 146 vs New 52-Week Lows: 80

McClellan Oscillator continues strong

New Highs - New Lows

We have recovered in a very bullish way above the MA10 line since the April dip

*This my personal blog and is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.

Bond Yields Are Already Flashing Caution

With 10-year (4.5%) and 30-year (4.8%) Treasury yields are elevated pushing higher. The correlation of “stocks going down bonds go up” started in 1988 but now is not longer the case.

Higher yields raise the discount rate on equities, pressuring valuations (especially tech and long-duration growth)

Debt servicing costs are getting higher for the U.S. government, which could push the deficit and debt spiral narrative further.

The downgrade reinforces this concern, meaning yields are less likely to fall even in economic weakness.

This dynamic removes the Fed “put.”

I Believe We’re Heading Towards Stagflation

GLD chart

I believe the gold and bond market (and eventually, Bitcoin as I expect it to break out to new all time highs) are pricing in a future of stagflation.

In a stagflationary environment where inflation remains sticky while growth slows we should be seeing both asset classes declining together. That’s exactly what we’re starting to see now.

Elevated Long-Term Yields:

The U.S. 10Y at ~4.5% and 30Y at ~4.8% is not consistent with soft growth or falling inflation.

Instead, it suggests markets are demanding higher compensation for inflation risk and fiscal instability.

Rising Yields ≠ Confidence:

Normally, yields rise on strong growth. But in this case, yields are rising due to deteriorating credit confidence (e.g. debt/GDP > 130%) and ineffective tariffs policy, not optimism. (See more data below on slowing growth)

That’s bearish for bonds and bearish for equities if corporate borrowing costs rise sharply.

Breakdown of Diversification:

When both stocks and bonds fall, it challenges 60/40 portfolios, risk parity strategies, and passive flows. Volatility rises.

Sticky Inflation Pressures:

Factors like Trump tariffs, supply chain reshoring due to the pendulum shift away from globalization or global trade, and labor shortages (anti-immigration) all contribute to persistent inflation combined with slowing economic growth.

In general, global growth forecasts are trending down.

If Japan’s GPIF or other major institutions begin reallocating away from U.S. Treasuries due to more attractive domestic yields, it could put upward pressure on U.S. long-end rates. This would steepen the yield curve and raise borrowing costs which is bearish for long-duration U.S. Treasuries.

While rising global yields typically compress equity valuations, markets haven’t fully priced in the downside yet. But once yields cross key risk thresholds, equities could face sharper repricing.

Oil price weakness is a signal of slowing global demand.

Trump admin is causing a lost in confidence (ineffective policies is a key piece to what contributes to stagflation environments)

This negative outlook below might have already been priced in by the market from the April correction.

Although Trump backed down from the crazy high 145% tariffs, we still have tariffs in place which contribute to inflation. While retail sales are cooling, prices are picking up (partly due to tariffs as retailers like Walmart announced prices will be increasing).

Stagflation points

High inflation (risk not immediate): While headline inflation has moderated recently, thanks to softer CPI and PPI prints, structural risks remain. The U.S. debt burden is now approaching 130% of GDP which raises critical questions about how this debt will be serviced. If the government resorts to increased debt issuance or monetization through the Fed, it could eventually reignite inflationary pressures.

Low Economic Activities: There are no glaring red flags yet in hard data, but soft data and consumer surveys are signaling a slowdown in spending. As confidence wanes and savings buffers shrink, we could see a meaningful dip in consumption.

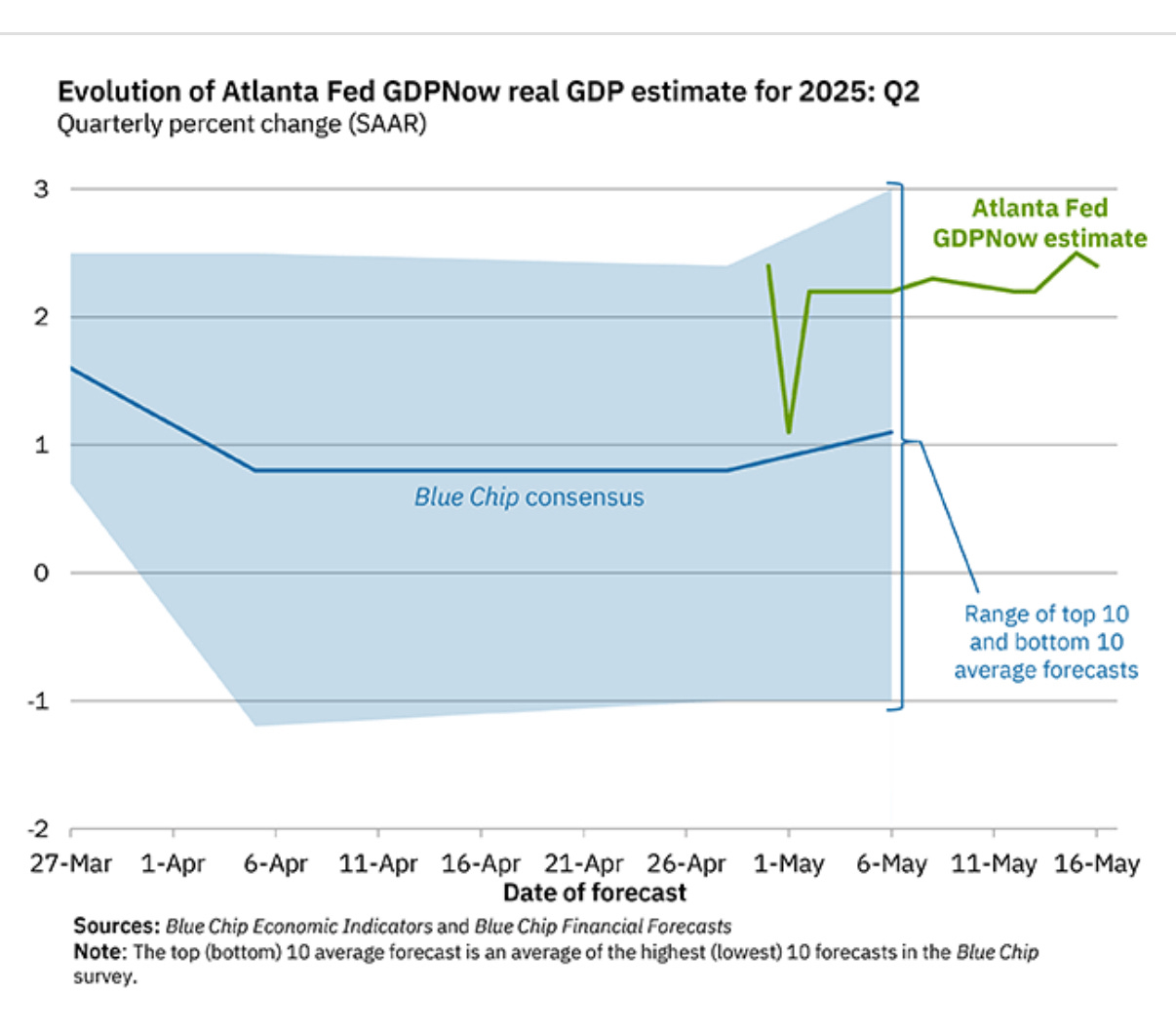

Low GDP: Recent GDP weakness was partially driven by the impact of tariffs and trade disruption. However, with the Trump administration walking back on some of its more aggressive tariff rhetoric and restarting trade negotiations, a short-term rebound is possible. The outlook hinges on whether these talks lead to actual policy shifts or just more uncertainty. GDP growth is declining from all major countries.

Poor Government Policies: The first 100 days of the Trump administration have been marked by policy volatility, mixed messaging, and reactive governance. The upcoming unresolved debt ceiling is a major risk event around the corner and internal discord within the White House which leads to elevated policy risk.

High Unemployment Rate: While unemployment remains relatively low for now, the accelerating adoption of AI across industries could soon change that. As companies increasingly leverage AI to automate tasks and reduce costs, many human roles risk becoming obsolete. The challenge is that displaced workers may not be able to reskill quickly or effectively enough to keep pace with the shift. This will create a transition period marked by elevated unemployment and labor market dislocation.

Bullish Perspective

GDP growth has recovered to over 2.0%.

Forecast

Keep reading with a 7-day free trial

Subscribe to Best of Twitter/Threads, Analysis & Forecasts to keep reading this post and get 7 days of free access to the full post archives.