Megacaps Will Push SPX to 7000

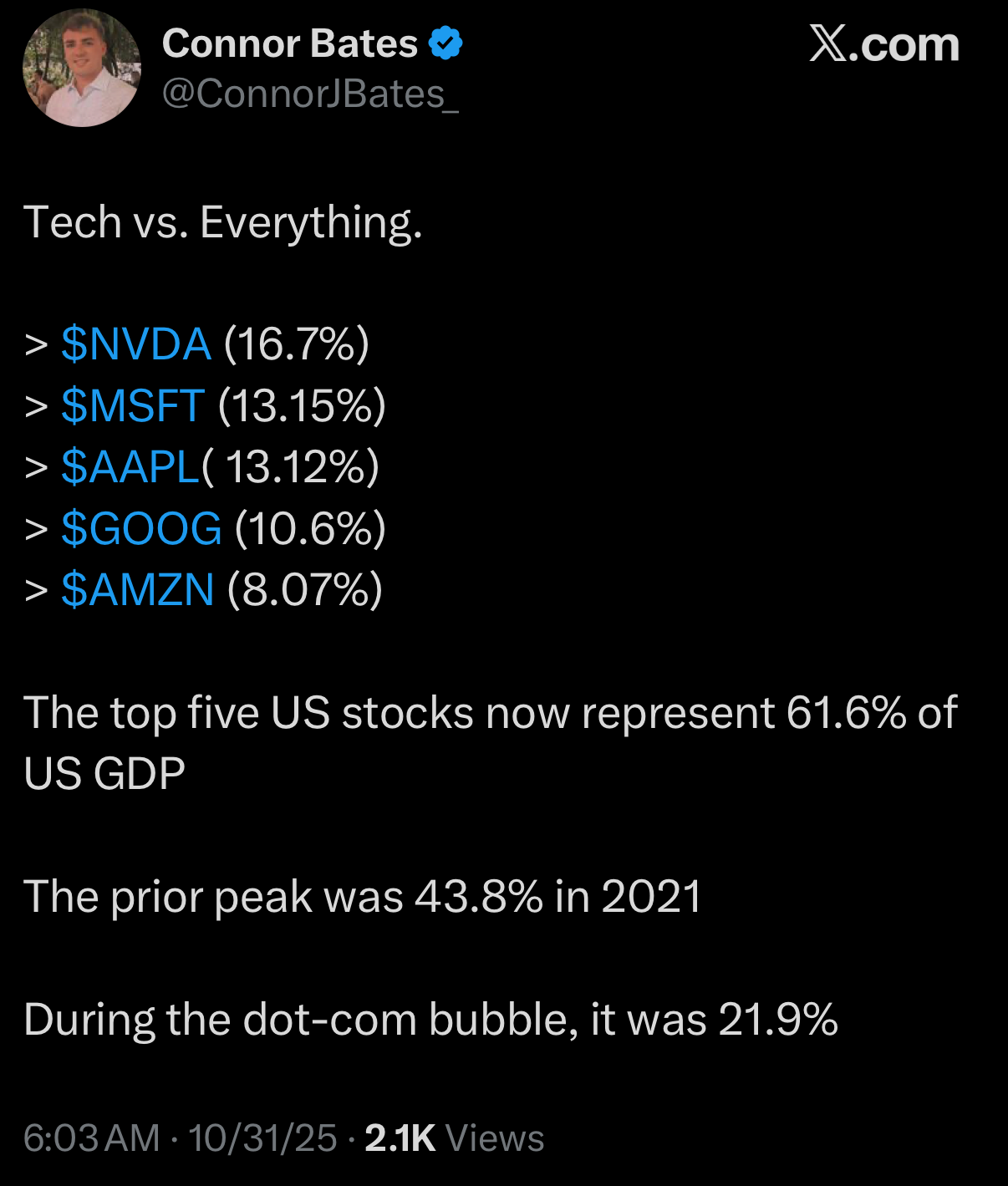

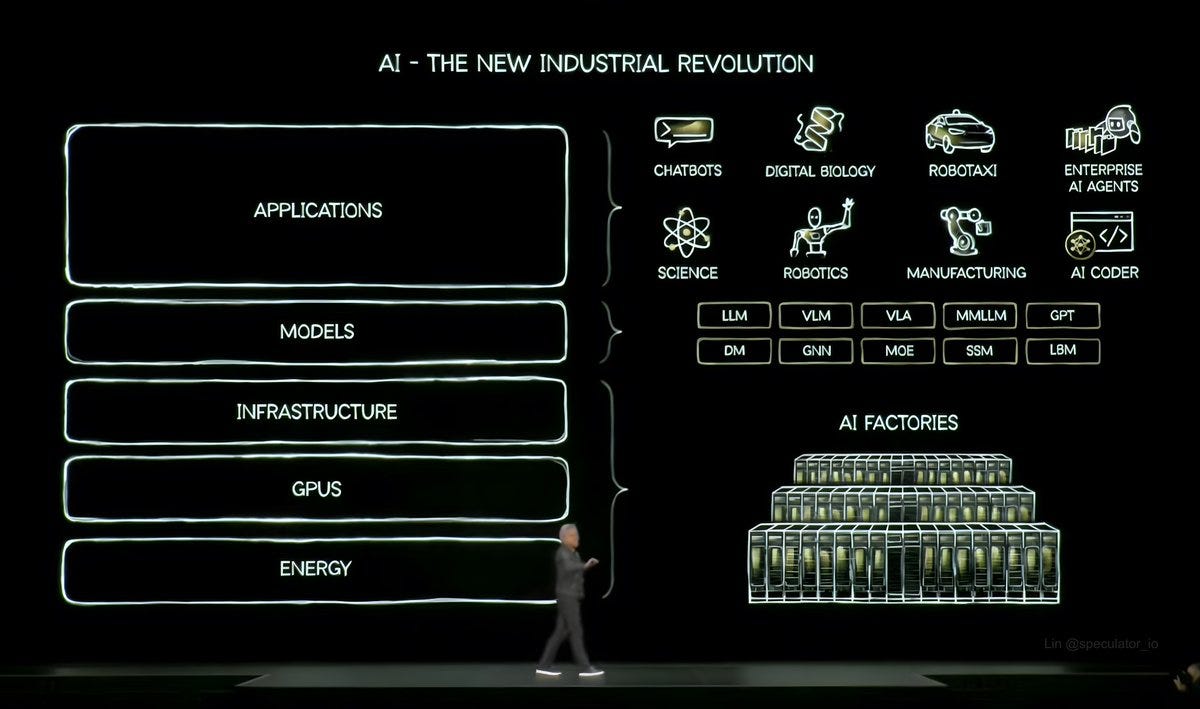

Concentration into AI winners and Megacaps will get even worst

Recap

✅ I shared 2 weeks ago that Megacaps would power the market higher

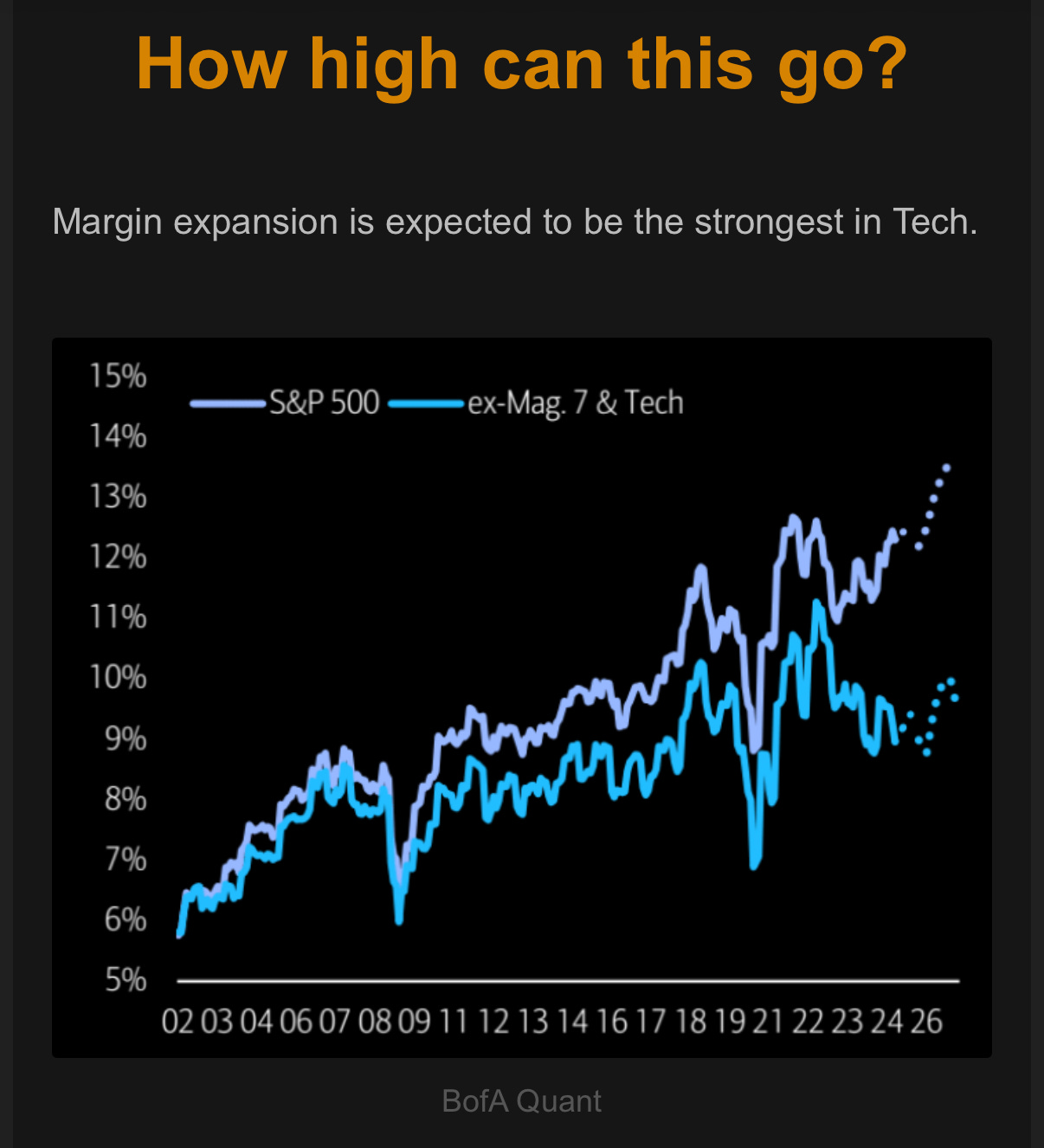

The megacaps powering the market higher will continue, this bubble is going to get bigger (after a short term pullback) and capital will flow even more into the megacaps and AI hyperscalers.

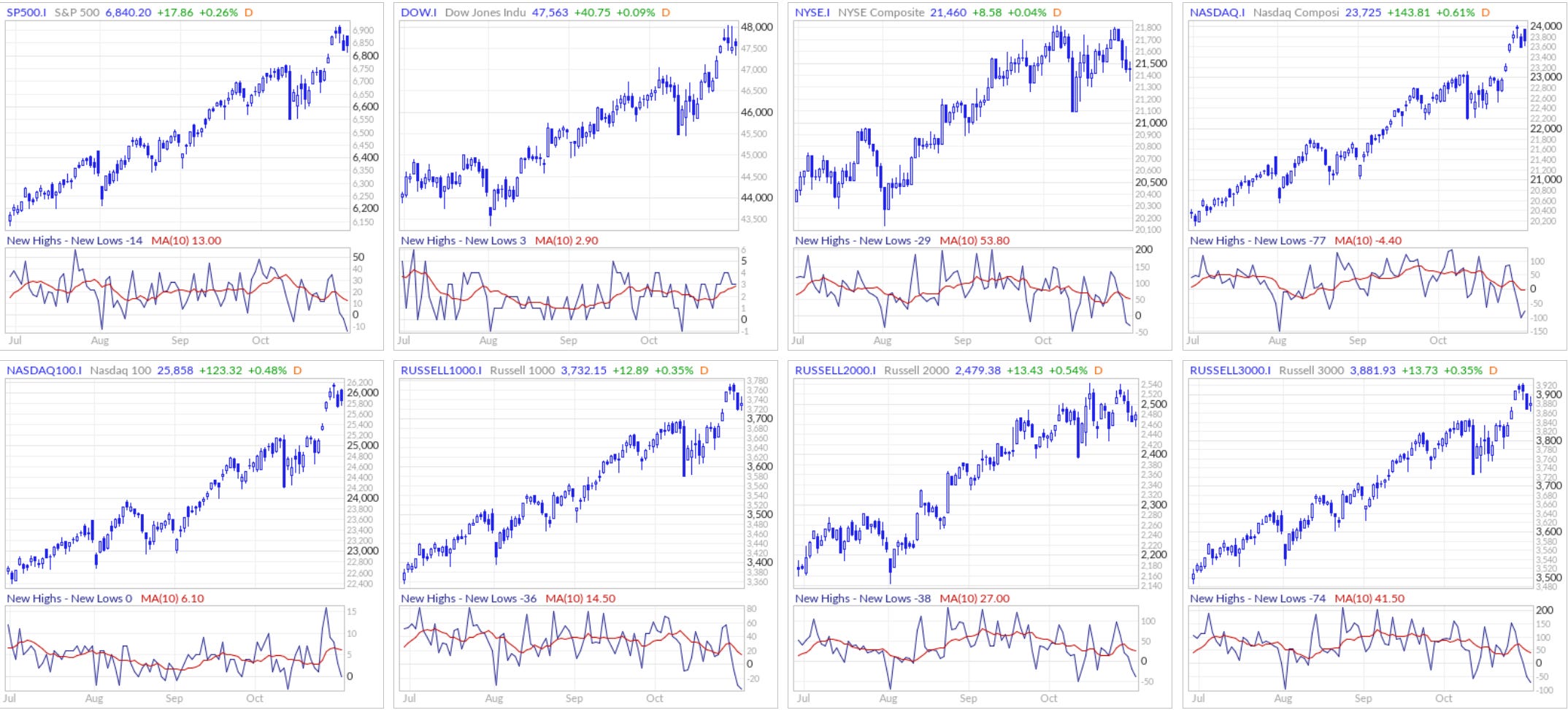

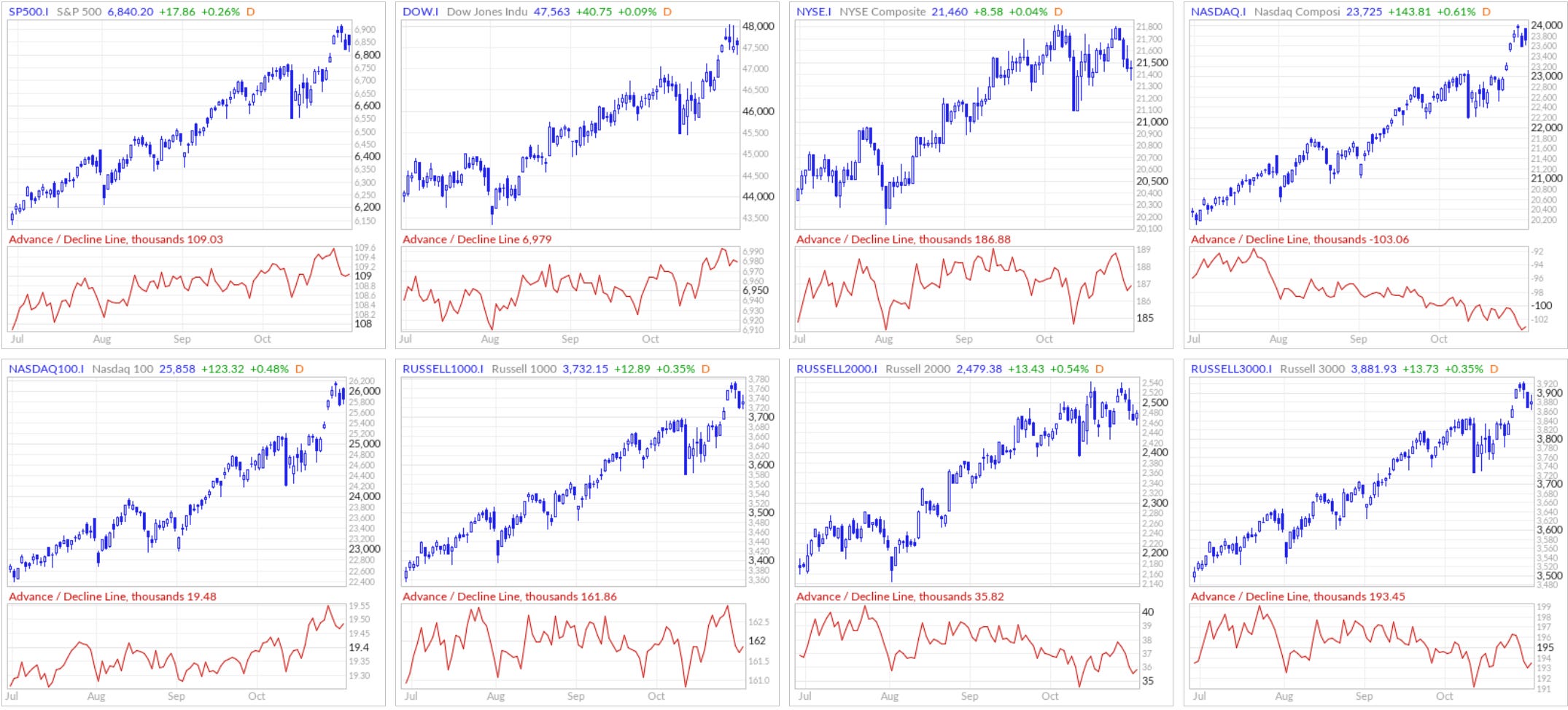

New 52-Week Highs vs New 52-Week Lows

NYSE New 52-Week Highs: 65 vs New 52-Week Lows: 97

Nasdaq New 52-Week Highs: 118 vs New 52-Week Lows: 179

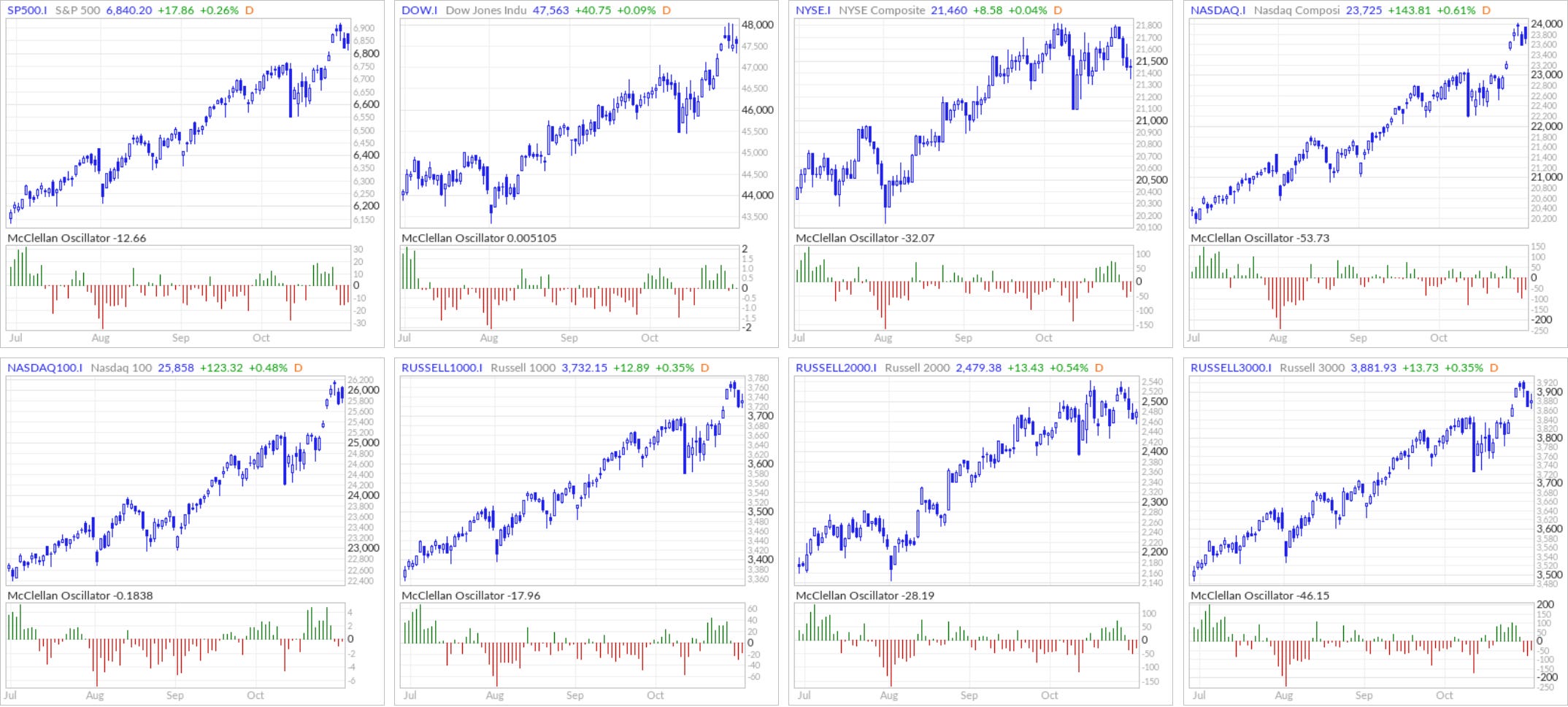

McClellan Oscillator

New Highs minus New Lows (NH–NL)

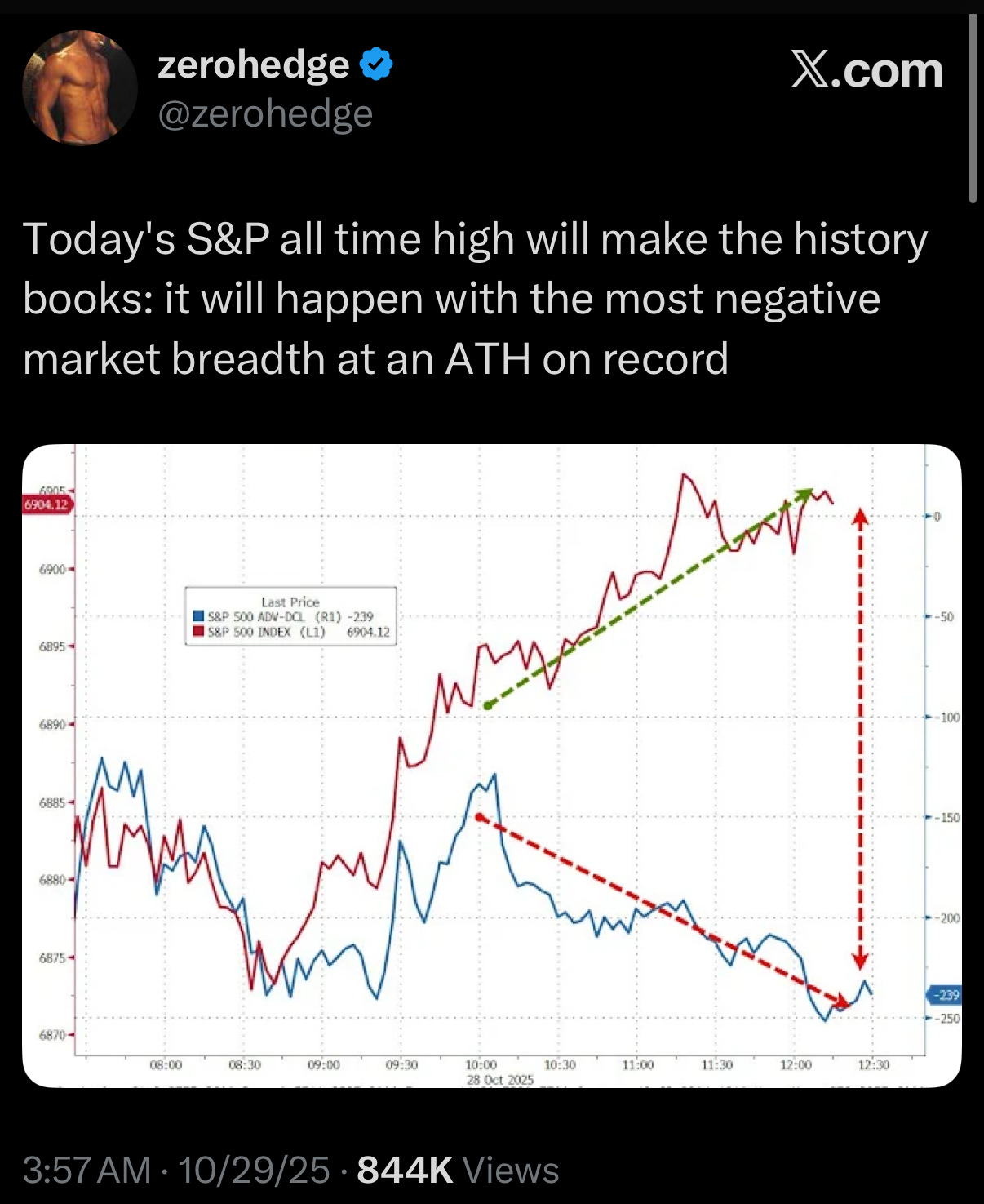

Across nearly all indices, the NH–NL indicator is near zero or negative, meaning:

Even as price indices hit new highs, few individual stocks are making new 52-week highs.

In the Nasdaq’s case, NH–NL is significantly negative, confirming narrow leadership.

The S&P 500 and Dow are slightly positive, but the NY Composite and Russell 2000/3000 are negative.

The moving average (red line) for NH–NL is trending lower — suggesting diminishing momentum beneath the surface.

This is a classic late-cycle behavior: the index keeps rising due to a handful of leaders while the majority of stocks stall or weaken. When NH–NL diverges negatively for long enough, it often precedes a market top or rotation phase.

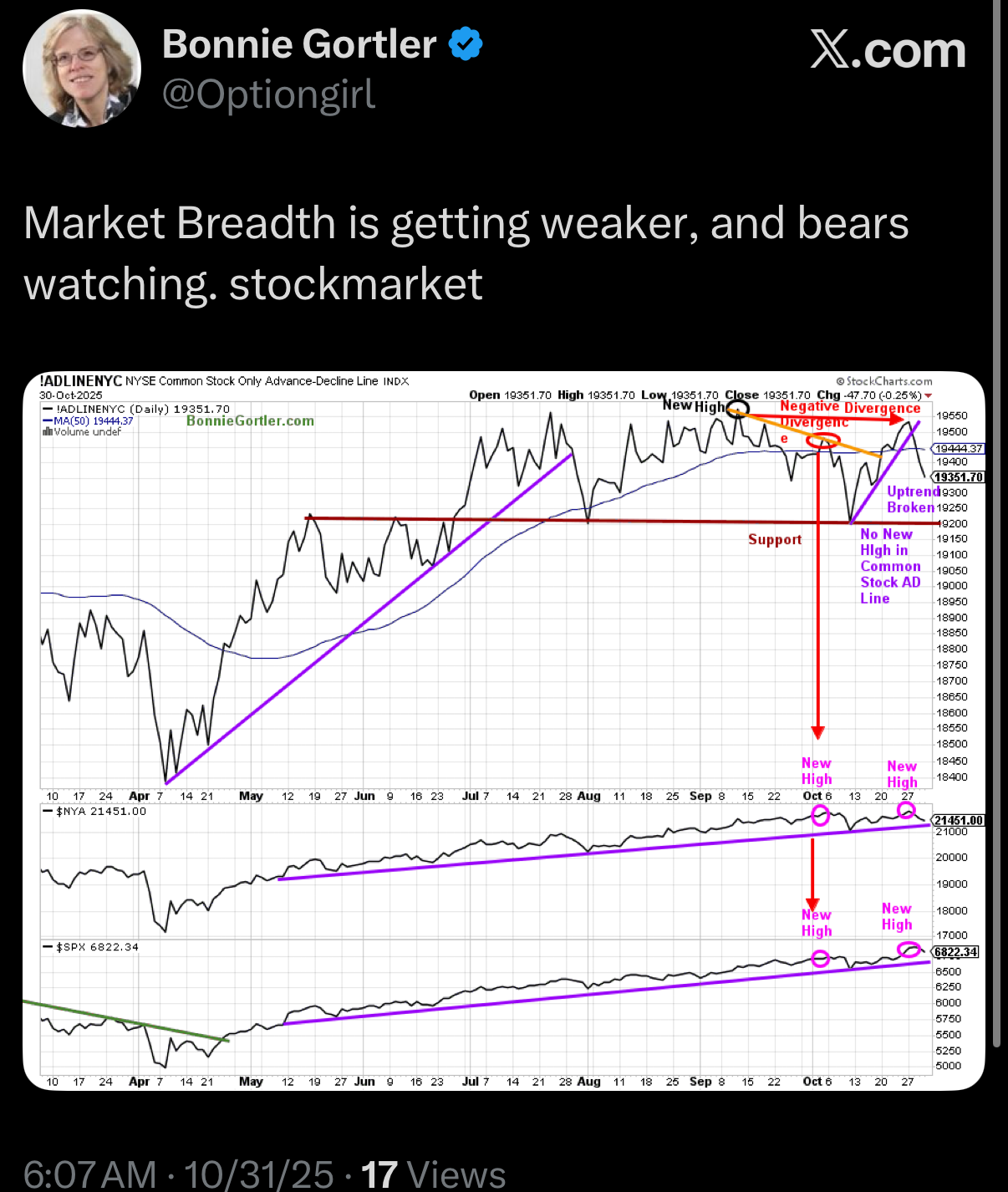

Advance/Decline Line (A/D Line)

S&P 500 (SP500), Dow, and Russell 1000/3000: all have price indices at or near new highs, but their A/D lines have flattened or turned slightly down. This means fewer stocks are participating in the advance.

Nasdaq & Nasdaq 100: their A/D lines are trending down sharply despite strong price action. The rally here is very narrow and dominated by a few megacaps (e.g., NVDA, MSFT, GOOGL).

Russell 2000 (small caps): A/D is weak and rolling over. Small caps aren’t confirming the broader market’s strength.

The A/D lines are not confirming the new highs in major indices — a negative breadth divergence. Historically, that often precedes short-term corrections or consolidation phases.

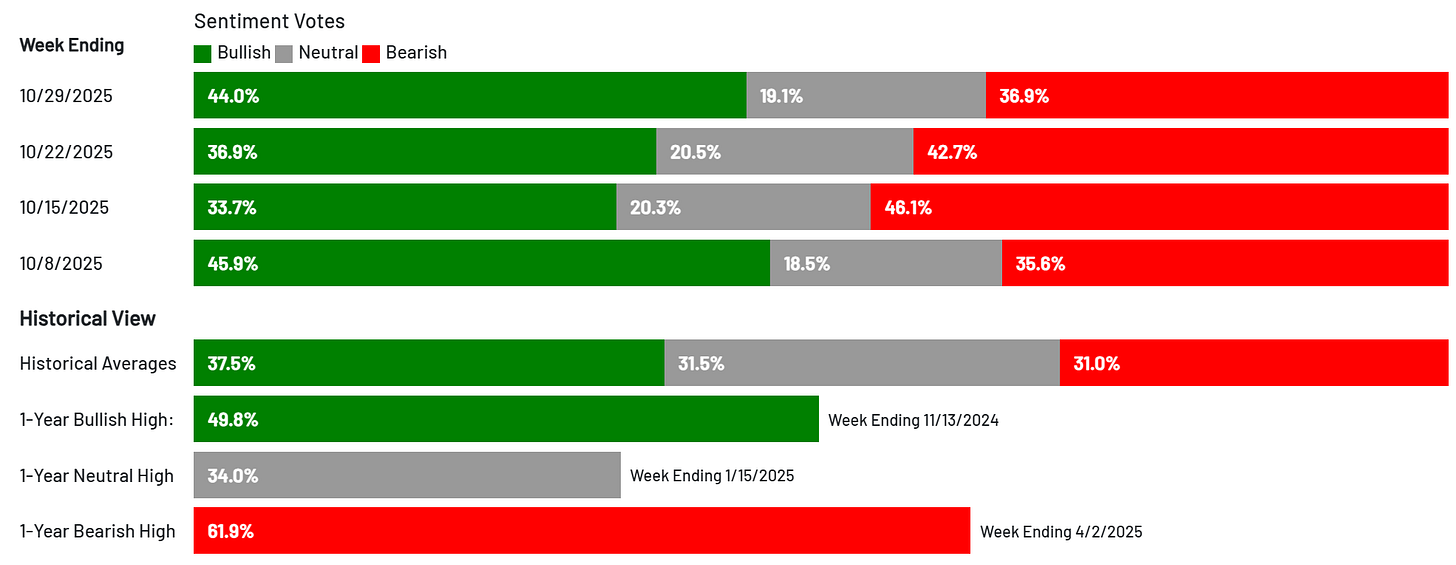

Market continues in fear

AAII Investor Sentiment jumps bullish (and diverges from CNN’s Fear & Greed index)

*This my personal blog and is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.

Posts of Interest

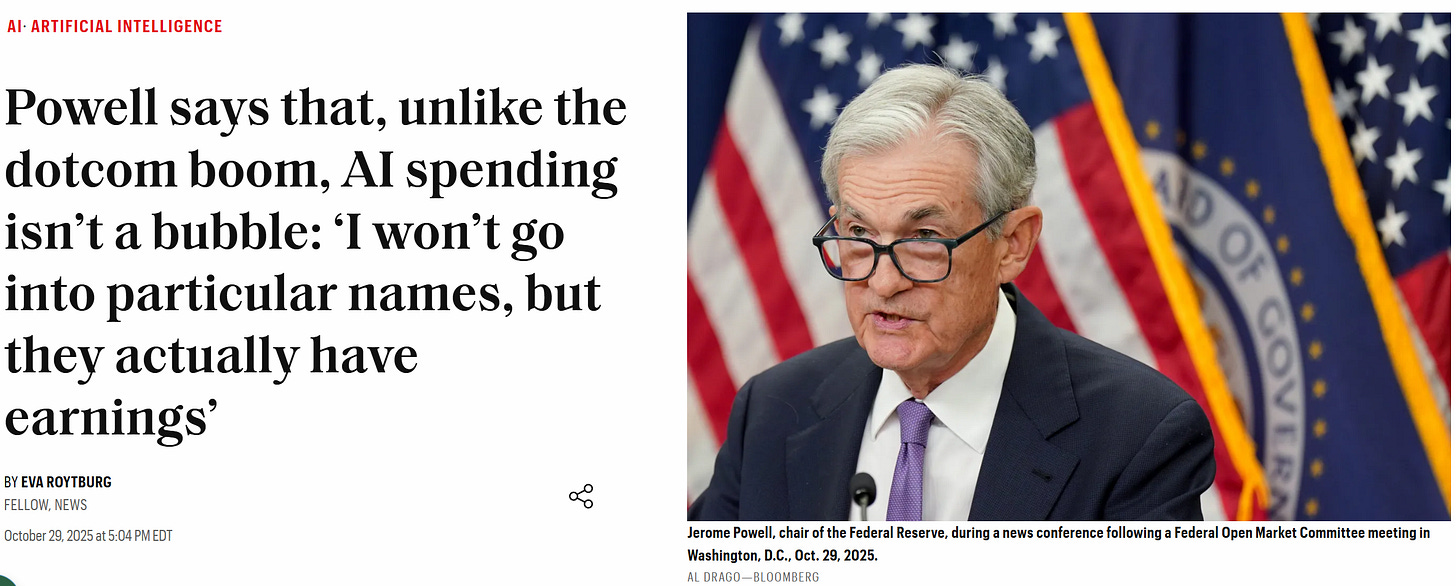

If it wasn’t for tech, the US economy likely would be in a mild recession by now.

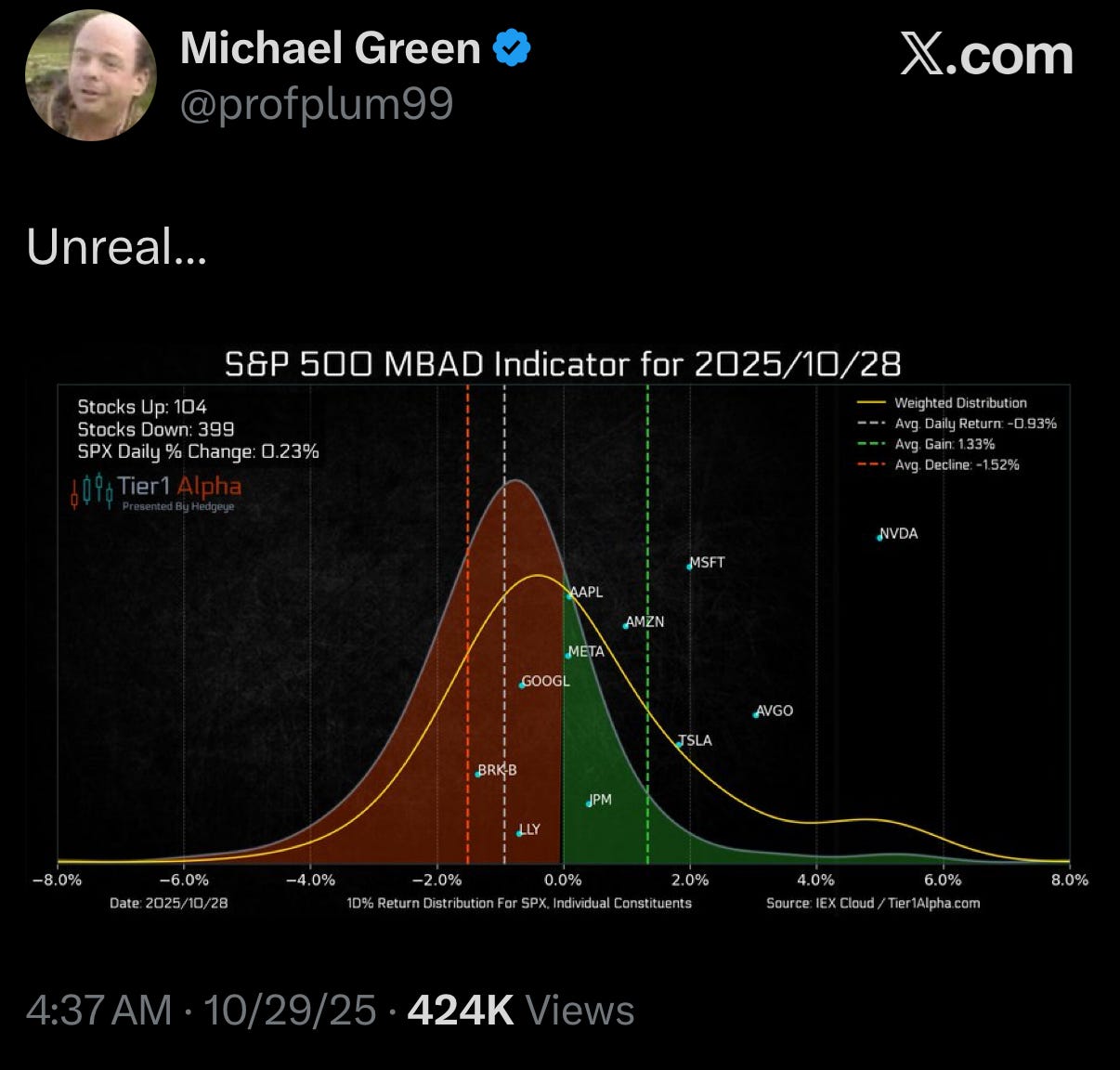

And megacaps are powering the S&P 500 higher

While market breadth slowly gets weaker—those of you who hold stocks that are non-AI or non-megacap are likely seeing those stock positions either drop to new lows or close to testing prior lows.

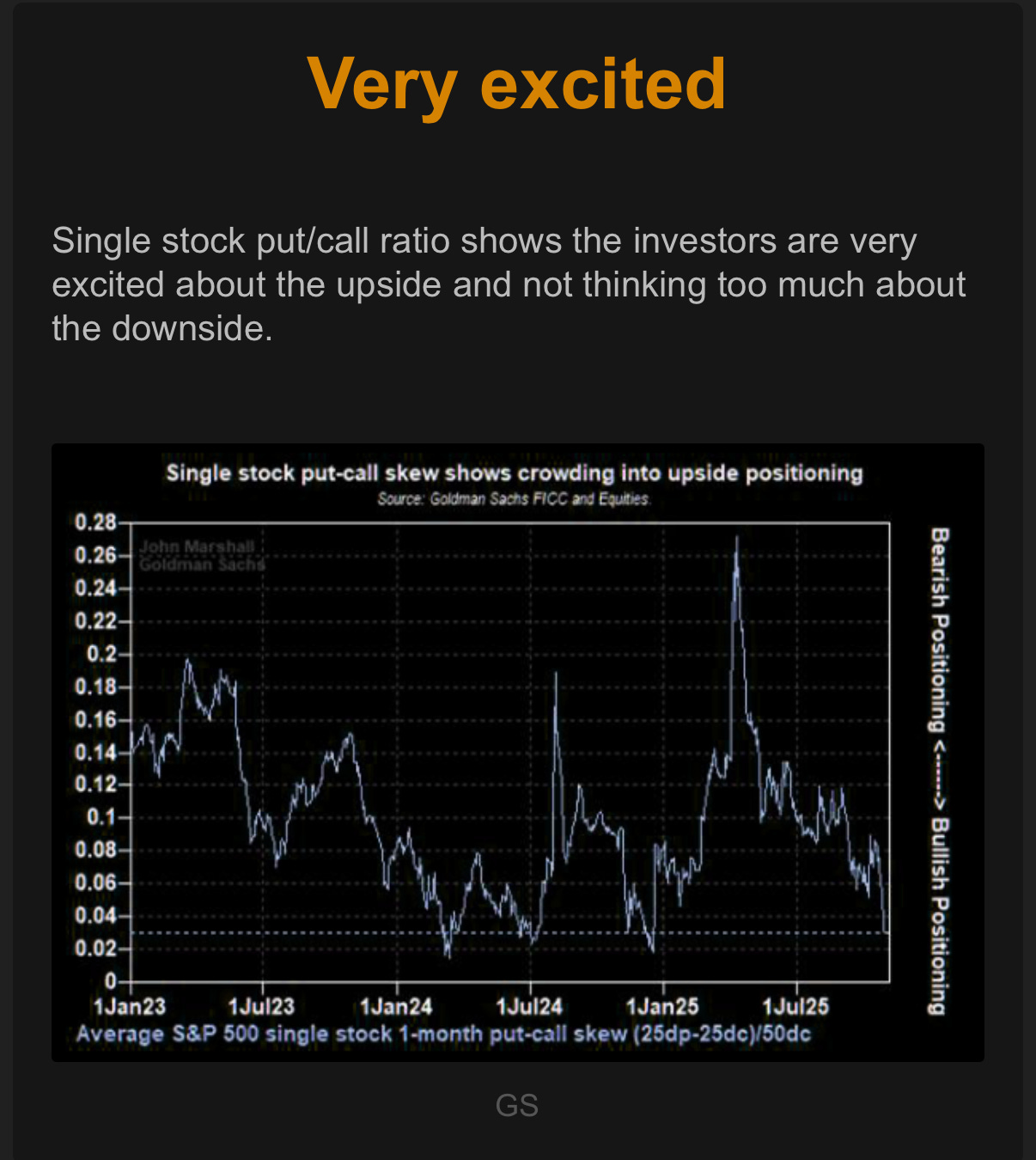

Option traders are overly bullish and that’s a sign to be cautious

CAT 0.00%↑ was one of my picks I shared weeks ago and it continues to see new ATHs since they support AI infrastructure.

US Government Shutdown needs to be resolved soon otherwise it will have a larger negative impact to the US economy.

I will also share this at the bottom with my stock picks because this screenshot is from Jensen Huang’s Nvidia GTC presentation in Washington, DC. This is basically my investment thesis for the next 5 years.

Forecast

Momentum beneath the surface is weakening. The market is being lifted by fewer names, and money is quietly rotating out of broad equities and concentrating furthermore into megacap stocks pushing the marketing to new ATHs while beneath the surface the majority of stocks are not participating in ATHs.

Keep reading with a 7-day free trial

Subscribe to Best of Twitter/Threads, Analysis & Forecasts to keep reading this post and get 7 days of free access to the full post archives.