Recap

✅ Let’s see if this forecast from last week plays out and the dip upcoming in late June to July will be short-lived

New 52-Week Highs vs New 52-Week Lows

NYSE New 52-Week Highs: 44 vs New 52-Week Lows: 60

Nasdaq New 52-Week Highs: 79 vs New 52-Week Lows: 129

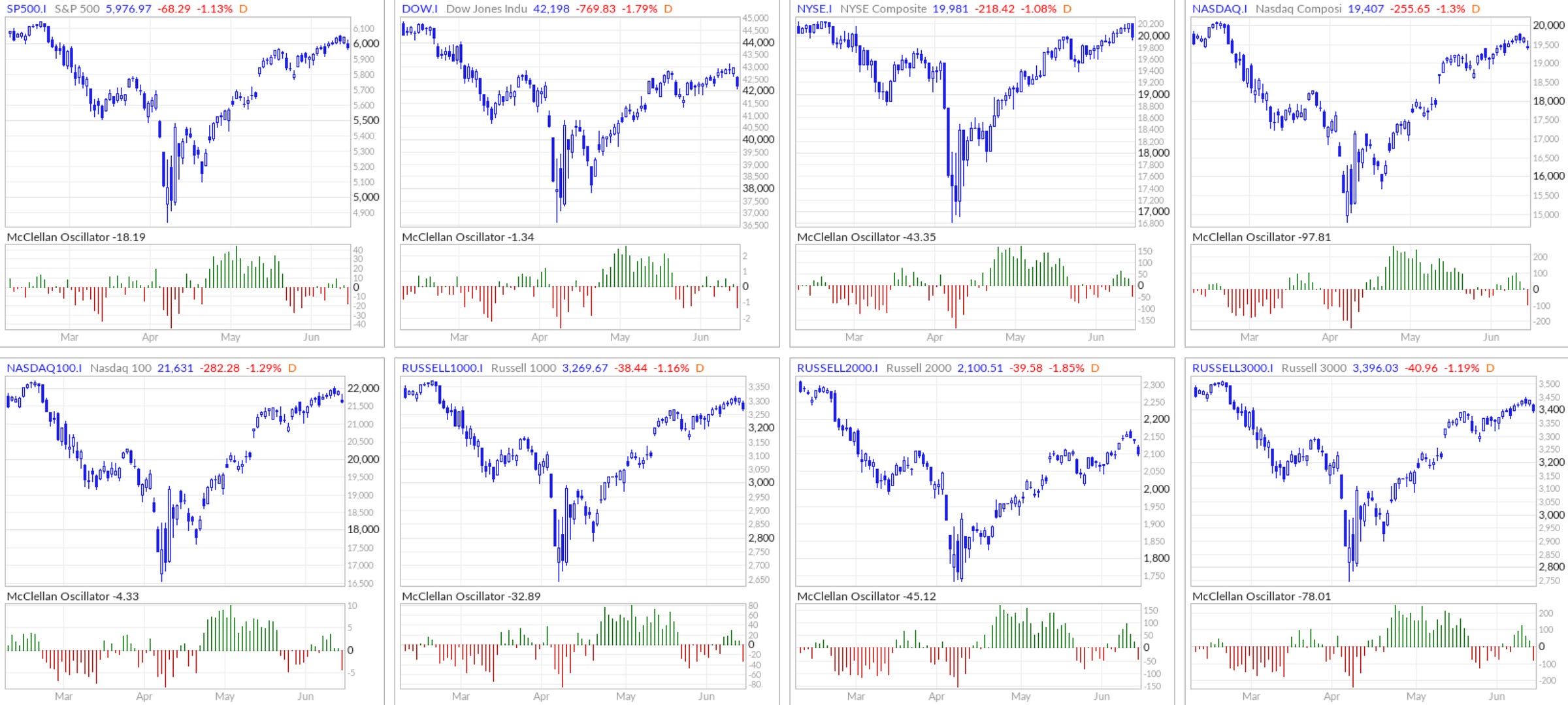

McClellan Oscillator

New Highs - New Lows

*This my personal blog and is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.

Posts of Interest

Given the Israel-Iran conflict escalating, the 210-212 level for IEM is a key level for the weekly close

Markets React to Escalating Israel-Iran Tensions

The recent escalation between Israel and Iran has evolved into one of the most significant geopolitical crises of 2025. What are the 2nd order effects concerning oil, commodities, defense, and macroeconomics. This regional issue will have global impact especially if the Trump Administration decides to involve the US heavily.

If you look at history, Iran and Israel have engaged in proxy warfare through Hezbollah, cyber operations, and covert sabotage. However, this time, the conflict is moving into the open, and both sides are publicly signaling a willingness to escalate.

Israel and Iran are striking each other but the key is that Iran threatened to target U.S. bases in the region. And we have U.S. Navy repositioning warships closer to the Persian Gulf.

The Strait of Hormuz accounts for 20% of the world’s daily oil flows

Brent crude briefly surged above $90 as traders began pricing in tail-risk scenarios around maritime blockades or missile threats.

Iran is the 7th largest oil producer globally where analysts estimate about 3.3% of total global supply. What happens to the Strait of Hormuz is key since much of Iraq’s, Kuwait’s, and parts of Saudi Arabia’s must pass through this narrow passage. Any Iranian attempt to blockade the strait, even temporarily, could disrupt over 15 million barrels per day of transit.

This would reinforce sticky inflation at a time when central banks are already paralyzed by stagflation concerns. Therefore:"

Short-term risk-off (dip buying opportunity) in global markets, especially AI

Defensive sectors (energy, utilities, defense) may do well until the situation de-escalates

Gold and Bitcoin will continue to gain further as hedges

If this conflict worsens, it could act as a regime shift catalyst from soft-landing optimism to a stagflationary reality.

Will things escalate into a broader regional war involving Lebanon, Syria, and Iraq?

Will oil sustain above $100?

If these 2 things happen above then there will be a repricing of risk in U.S. Treasuries and credit markets and we could revisit the lows in April.

Forecast

Market is still in Greed and looks to be reversing down to revisit Neutral then Fear.

The market is currently in greed and VIX revisiting over 30 would be a dip upcoming

Just as AAII Sentiment shifts 36.7% bullish the Israel-Iran situation unfolds

Keep reading with a 7-day free trial

Subscribe to Best of Twitter/Threads, Analysis & Forecasts to keep reading this post and get 7 days of free access to the full post archives.