Higher for Longer Until 2%

CPI wasn't terrible but it wasn't great either

Recap

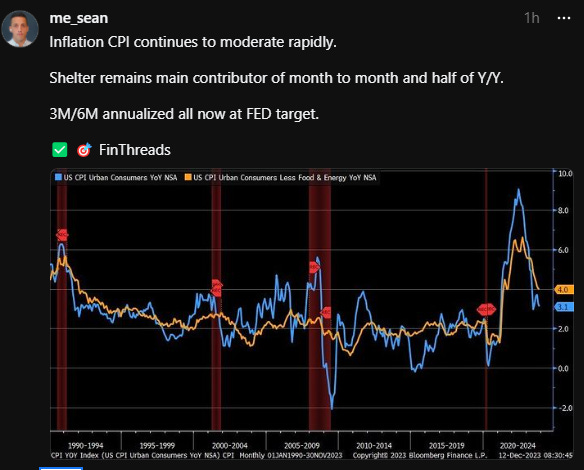

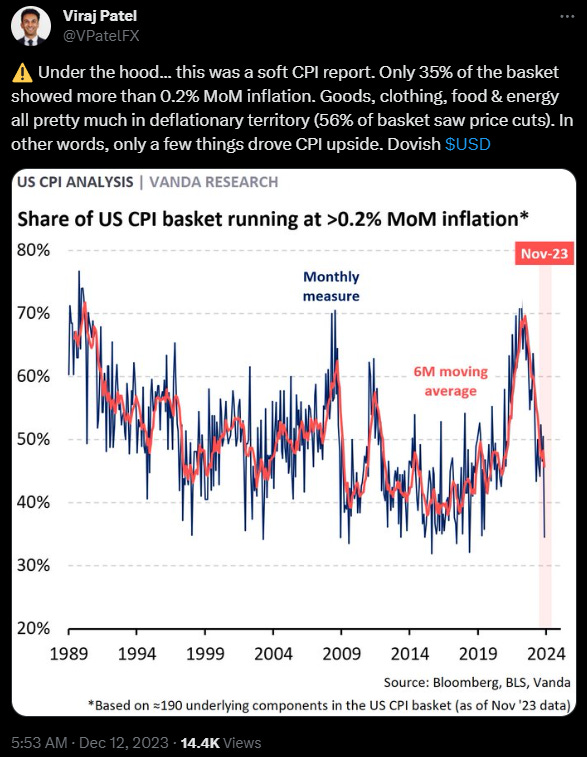

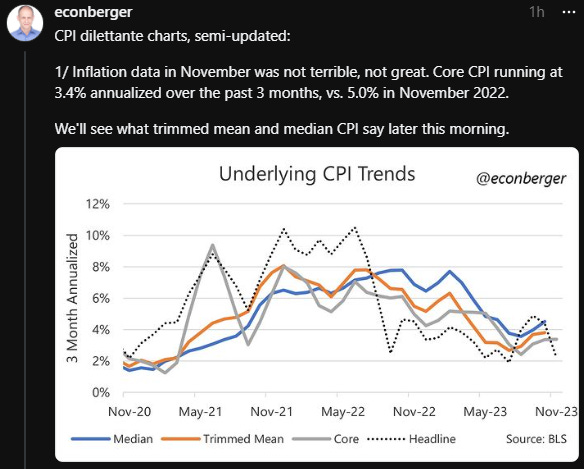

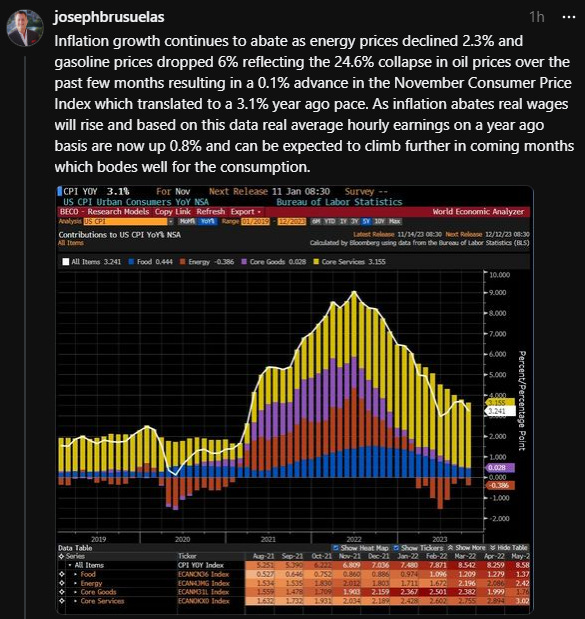

✅ The CPI print today was still a Goldilocks print; however, Core ticked up slightly since Oct. November CPI report suggests that overall inflation is on a downward trend, with a slight decrease in the annual rate and a stabilization in core inflation.

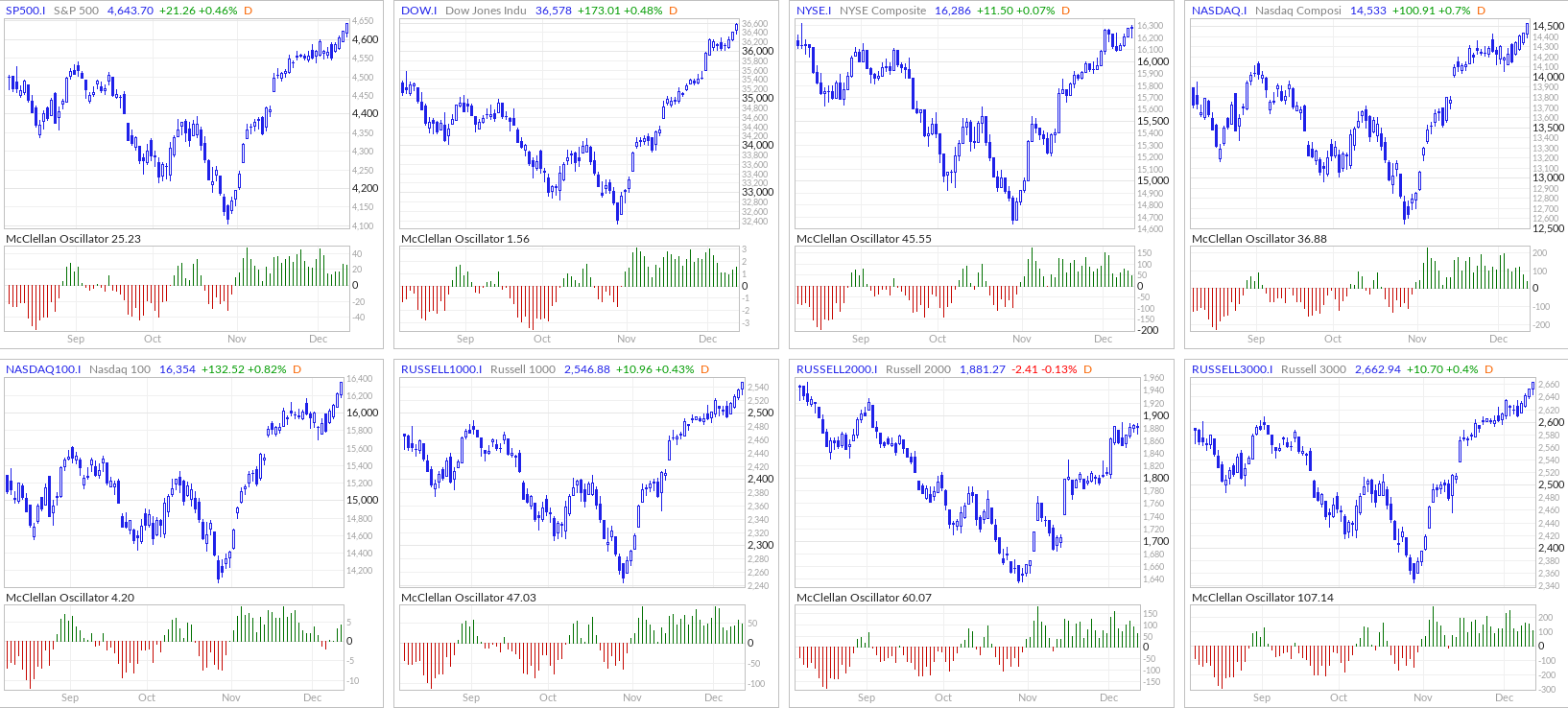

New 52-Week Highs vs New 52-Week Lows

NYSE New 52-Week Highs: 144 vs New 52-Week Lows: 44

Nasdaq New 52-Week Highs: 221 vs New 52-Week Lows: 188

McClellan Oscillator

New Highs - New Lows

*This my personal blog and is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.

CPI Recap

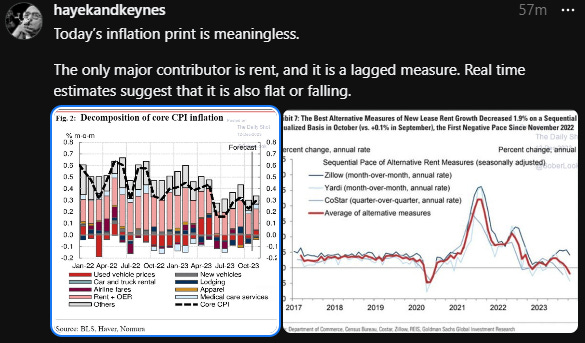

However, Core Inflation is all that matters—it’s flat-lining and stabilizing instead of falling further.

Real-time Zillow data of real-time rents show it’s going to be close to 0% inflation—so Core CPI should come down over time along with these falling rents.

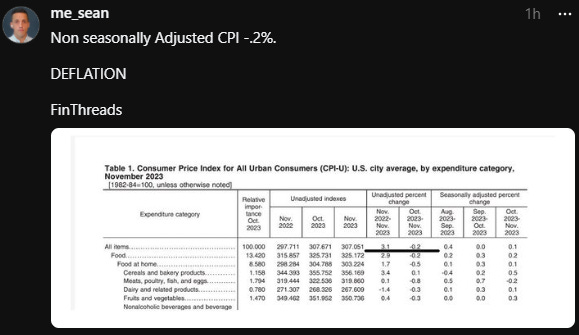

And goods inflation is in deflation.

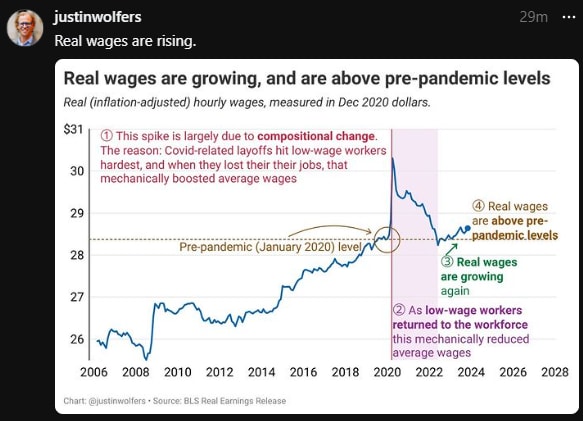

Where real wages are growing—this is bullish if real wages continue higher as disinflation continues (more income against prices falling—this is a Golden Path outcome).

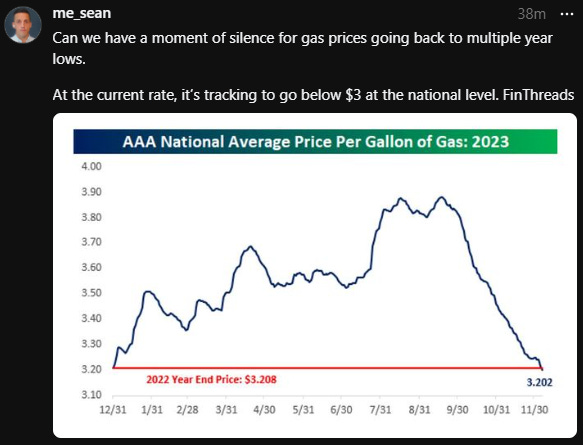

Gasoline continues to fall (US demand fell close to -1.5% and China gasoline demand fell -10%!)

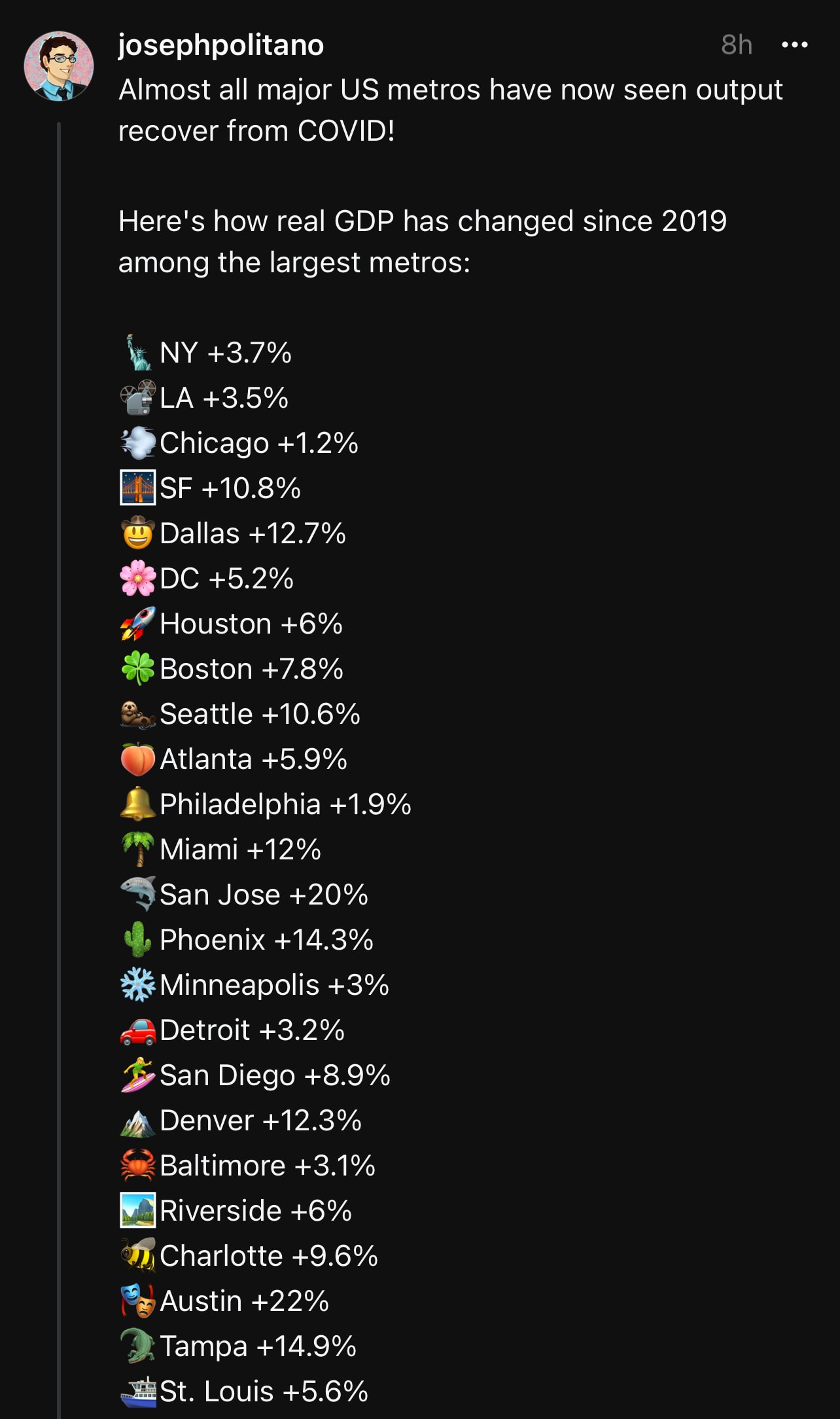

The US economy is in good shape as output recover from COVID and back to growth.

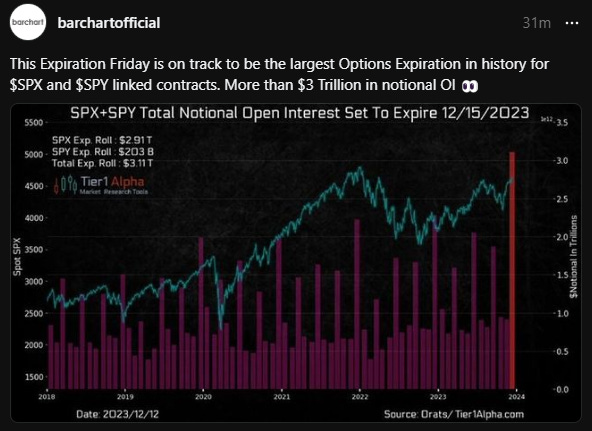

This could mean a big move is coming this Friday (see my forecast on thoughts)

Forecast: Higher for Longer (still)

Keep reading with a 7-day free trial

Subscribe to Best of Twitter/Threads, Analysis & Forecasts to keep reading this post and get 7 days of free access to the full post archives.