Freight Ripple Effects from April Tariffs Chaos is Going to Hit Soon

Fed and Powell is also this week

Recap

❌ Although we did retest close to SPX 5700, the market didn’t resume its downtrend after the Wed economic data came in (we did sell off on Wed but recovered and resumed higher once the jobs numbers came in better than expected).

New 52-Week Highs vs New 52-Week Lows

NYSE New 52-Week Highs: 58 vs New 52-Week Lows: 24

Nasdaq New 52-Week Highs: 116 vs New 52-Week Lows: 50

McClellan Summation Index

SPY, DOW and NYSE indices recover above 0

% Above 100DMA

Has recovered to the level before the large sell off

*This my personal blog and is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.

Posts of Interest

Although the jobs report came in better than expected, it looks at the past, not the future—and it continues to confirm how resilient and strong the US economy is.

GDP is still negative at -0.3%

Payroll growth is falling with jobless claims rising

Personal consumption is down 1.8% vs 4%

And inflation is at 3.7% where the GDP price index was 2.3% in 2024—so for the Fed, getting back to 2.0% is going to be harder than anticipated.

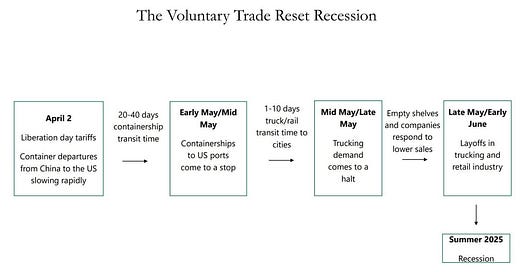

This is an interesting timeline to see if the data lines up and we do get more recessionary datapoints as we head towards summer—any weakness from this is likely going to get absorbed by the market especially if Bessent runs point and starts announcing trade deals with countries.

Recessionary data—will it recover on the next PMI report?

Interesting stat below but it really depends on how much damage tariffs have done so far and if Trump will continue to hurt global trade and doesn’t allow Bessent to take the wheel.

When retail is buying hand over fist, it’s usually not bullish but so far they are right and AAII investor sentiment is not.

Forecast

Majority of AAII Sentiment is bearish at close to 60% still—which usually means we can go higher.

And we’re still in Fear and not Neutral yet

VIX is now below it’s 50-day moving average

Keep reading with a 7-day free trial

Subscribe to Best of Twitter/Threads, Analysis & Forecasts to keep reading this post and get 7 days of free access to the full post archives.