This was supposed to be emailed to subs as a thread but a bug happened so just going to share to everyone.

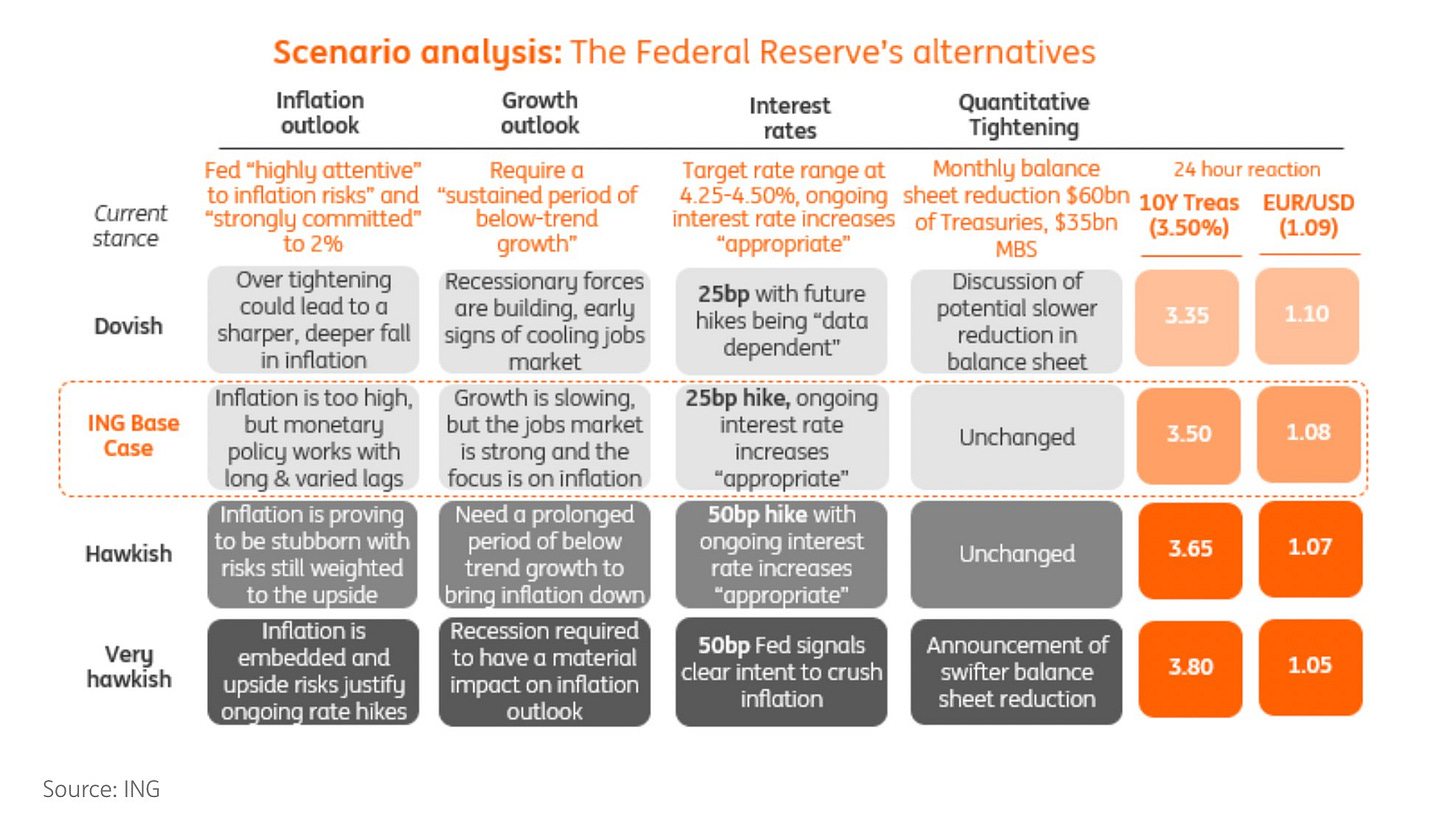

ING has a good chart below. Base case they lined out is likely but I’m still leaning at 50bps.

IV (implied volatility) for FOMC mtg is slightly high around ~30%, once the puts are closed it will lift the markets back up by 2-3%, so a 3% or so drop is around SPX 3950, that should be a strong bounce zone. On SPY the largest put walls are 388 then 390, these two levels will be the strongest support bounce areas.

Once the FOMC is priced in, we should march higher. The key is DXY regarding financial conditions. The Fed doesn’t want Financial conditions to loosen any more than it has already, so they’ll mention staying committed to QT to keep upward pressure on long term interest rates.

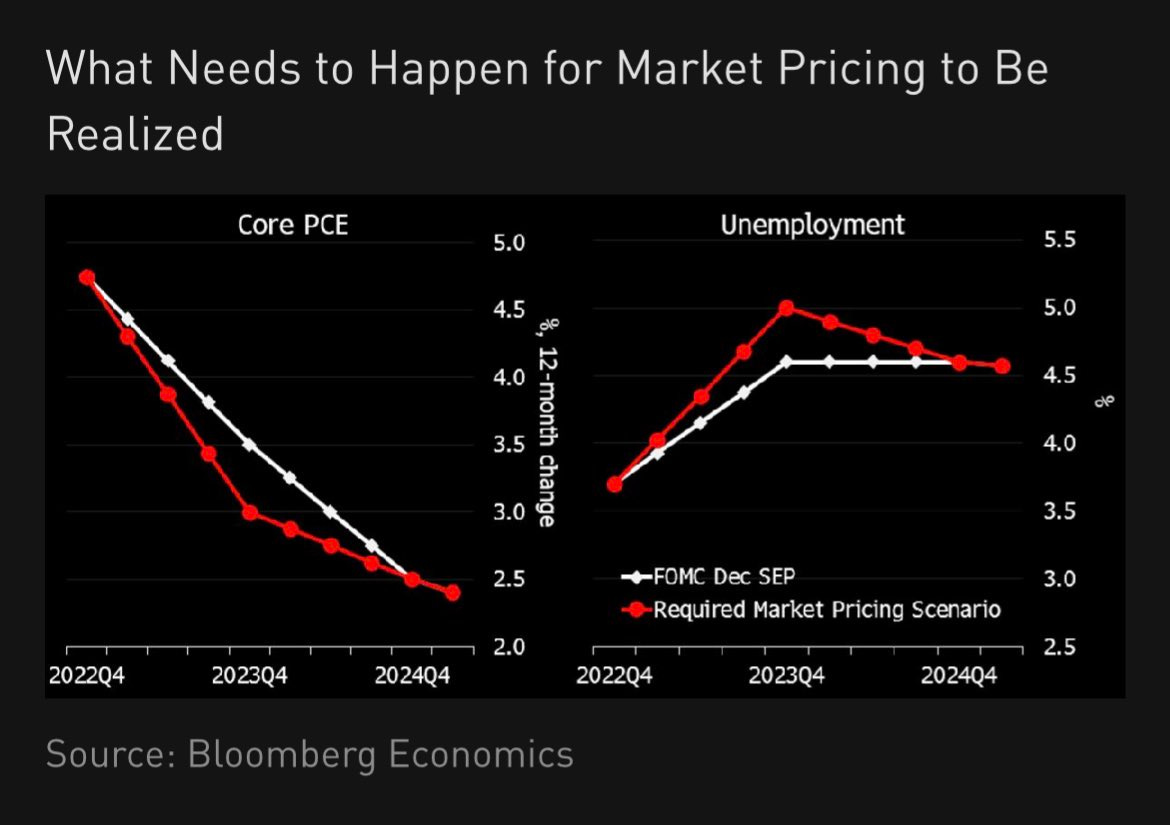

What is very hawkish is if they project unemployment to rise by 1.0%!!! That basically means they want a recession, unemployment rising from 3.4% to 4.4% or higher in their projections is HAWKISH, we should fall to 3800 or so on this. 1% unemployment uptick is around ~1.5M job losses. That is a recession. I would not buy the dip until prices bottom.

If you notice the chart below, if the updated Feb FOMC SEP comes in better (lower unemployment projections) that will send markets higher after whatever pullback is priced in from the implied volatility.

If they project unemployment to be <4.7% or so, it’s less hawkish and an improvement from previous FOMC. So the more important number the market will look at is the SEP and unemployment projection, how hawkish or aggressive is the Fed when it comes to the trade off of inflation vs unemployment?

Recall my Dec 16th Substack post

If the Fed is seen as starting to “favor” unemployment a little more by projecting lower than 4.7% unemployment in 2023, say for example 4.2% projection (this is more soft landing-ish) then SPX will go to 4300. SPX 4600 is also a farther out potential case especially if this Feb FOMC SEP and future FOMC SEP see unemployment at 4% or less while also projecting inflation continues to cool. That is quite a Goldilocks scenario.

Many stocks are still relatively low, DCA, I did that with ENPH, added more as price went higher and my thesis confirmed

Are you adding to longs now with this more dovish than I ever expected JP speech?