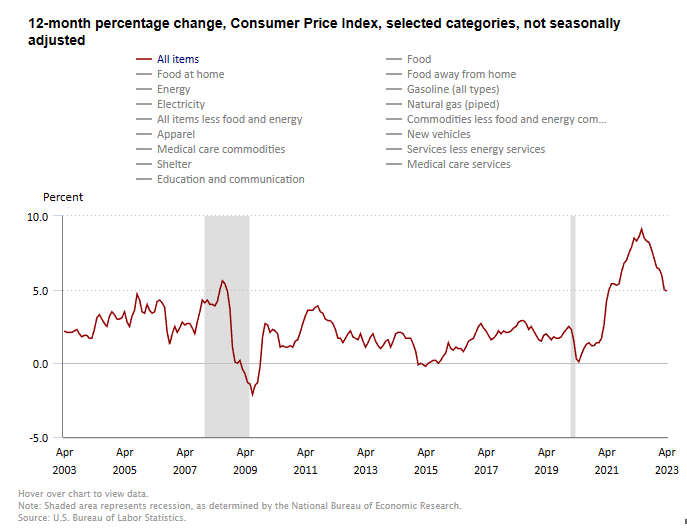

First Sub 5% CPI Reading in Two Years

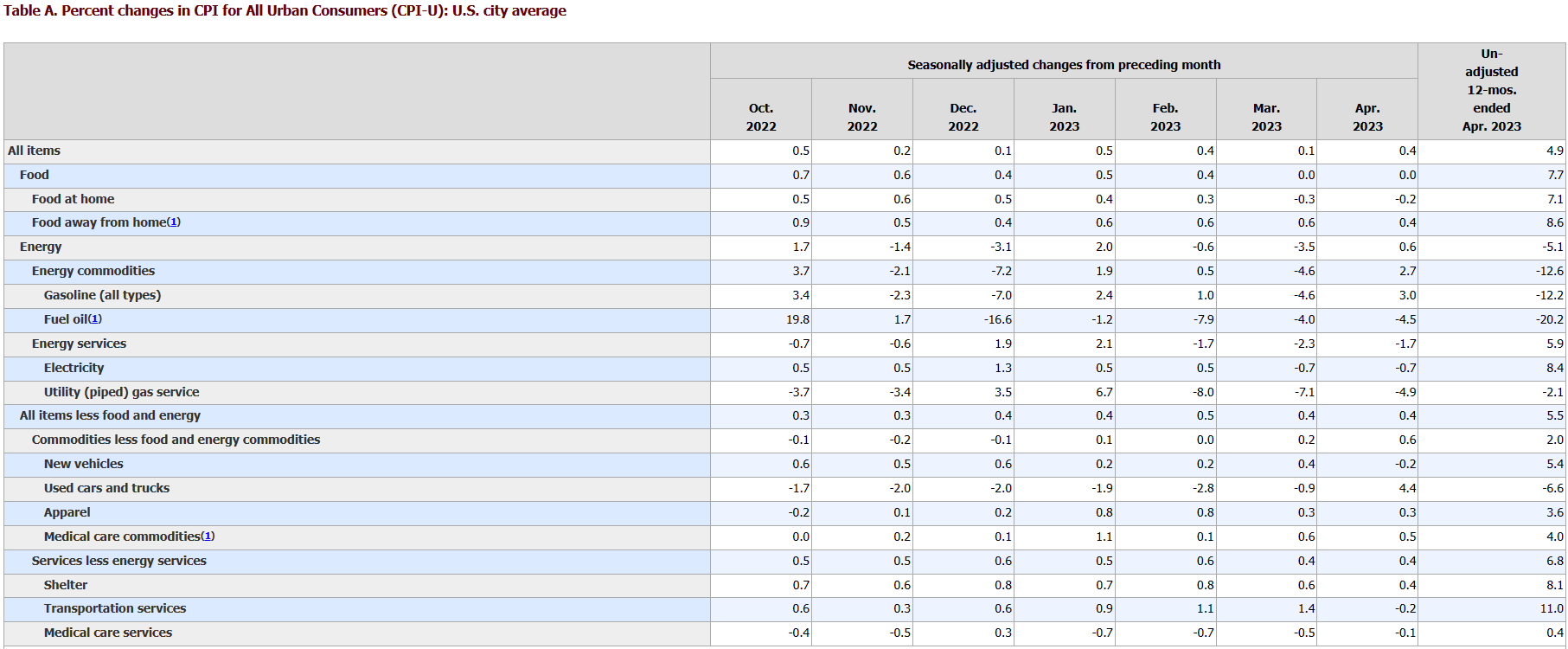

Bullish narrative is prevailing, CPI report shows some areas in outright deflation.

Highlights

SPY range 407-413 tmrw.

First sub 5% CPI reading in 2 years—the market is now more likely going to do that blow off top move I think could happen.

However, that fact we still couldn’t test SPY 420 off a better-than-expected CPI report is a sign that things aren’t all super bullish yet.

If you look at flows analysis below, put premiums levels are positive and now increasing when they were negative recently.

The market is staying within a range (underlying bullish rotation is happening to mid-caps and small caps as well as Amazon, etc.) and maybe this range won’t resolve up or down until the debt ceiling crisis is out the way.

Tomorrow is PPI and jobless claims, if better than expected reports still can’t push SPY to tap 420 and close above 415, I’d start getting cautious as next week is OPEX week and the Debt Ceiling Crisis will start to ramp up.

Debt Ceiling Crisis: based on jobs report, Fed Financial Stability report, and now CPI report…whatever dip the debt ceiling fiasco causes is going to be an epic dip buying opportunity.

Repeating what Powell shared: corporate margins are going to come down because as inflation recedes pricing power gets eroded. This means PepsiCo PEP 0.00%↑to Coca-Cola KO 0.00%↑ will get sold off and market will rotate to big tech like Amazon AMZN 0.00%↑ since tech companies tend to do better in a disinflationary environment (this market rotation has started today looks like).

Pepsi and Coke might be good shorts…🤔

Payments companies like Paypal PYPL 0.00%↑ to Block SQ 0.00%↑ are selling off because inflation is receding (in addition to some growth concerns). Higher prices = higher transaction fees and inflation coming down = lower fees, less income. However, they will be a huge swing opportunity since valuations have come down immensely. See below on my price targets and positions I have entered and will decide to enter.

Recap

✅ In the below Substack published on December 13, 2022, I shared that if the Fed is able to stay the course on tightening and finally get ahead of inflation I would be short-term bearish (which was on 🎯 back in Dec) and long-term bullish (my call for 2022 and how permabulls will look a lot smarter this year)

What I forecasted 5 months ago seems to now be playing out:

Therefore, if the Fed stays the course against inflation, even against higher unemployment, I would go long any panic sell offs or recession fears in 2023 because the recession might not materialize as we saw in 1983 and 1994.

52-Week Highs vs Lows are stabilizing here:

NYSE New 52-Week Highs: 60 vs New 52-Week Lows: 69

Nasdaq New 52-Week Highs: 109 vs New 52-Week Lows: 171

*This my personal blog and is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.

CPI Report

Powell might be right that we can avoid a recession.

If future CPI reports and jobs report continue like this, a soft landing is looking more and more likely.

Fintwit might say but but “inflation is transitory”, yea it was when Powell said it, he was right at that time, then it wasn’t transitory. What’s more important is the market took Powell’s words and priced in transitory inflation accordingly.

Can we have a recession later? Of course, but the market is not going to price that in given all the economic data coming out and what the Chairman of the Federal Reserve said—this reminds me of the “inflation is transitory” time period, the data did reflect that inflation would not be sticky until it wasn’t.

We will march on as if soft landing is happening as the market and Wall St are culturally and institutionally bullish until we start to turn a corner and realize recession could be materializing just how we realized back in Jan 2022 that inflation wasn’t transitory, and we got our 2022 Bear Market 🙂.

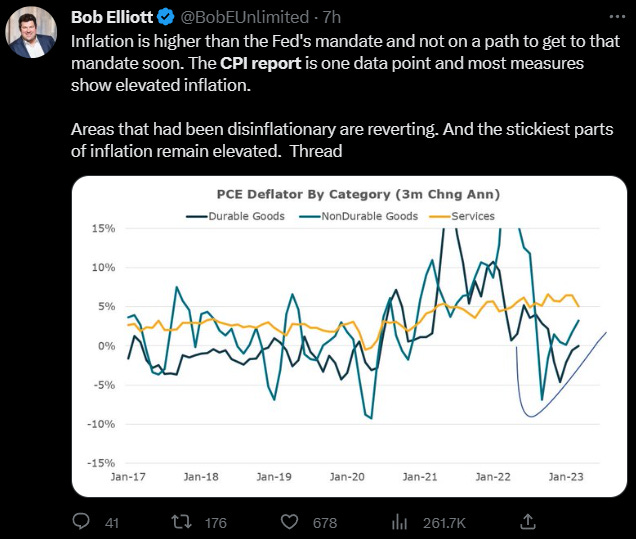

Agree the Fed will need a few more months to see price pressures truly receding.

Core inflation is still sticky so the Fed will continue to hold rates steady.

Swing Ideas and Positions Entered

If you’re a subscriber and didn’t follow the Palantir PLTR 0.00%↑ swing, don't worry, there will always be more swings and opportunities like the ones I'm sharing below.

Keep reading with a 7-day free trial

Subscribe to Best of Twitter/Threads, Analysis & Forecasts to keep reading this post and get 7 days of free access to the full post archives.