Competition for Yields: Bond vs Equity

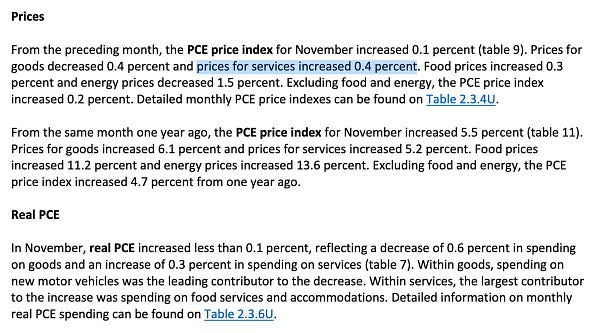

As expected, cooler PCE report sends us back closer towards 3900

Merry Christmas 🎄 everyone, hope you enjoy a nice weekend with family, friends, and get some nice relaxing time to yourself. Thanks for everyone’s feedback via comments, emails, etc. so please continue to share any ideas, suggestions, or even criticism as I welcome it all. ☺️

Today

NYSE New 52-Week Lows: 82 vs New 52-Week Highs: 52

Nasdaq New 52-Week Lows: 275 vs New 52-Week Highs: 80

As I pointed out previously, the new 52-Week lows are declining now from 400+, so why I noted a bounce would be imminent and I’m swinging it

A retest to 3900 is likely—but the long-term is still iffy due to higher rates all around the world

The $1.7 trillion fiscal year 2023 bill was passed by the US House and will proceed to Biden’s desk. Short term this is bullish but longer term the spending portions of the bill will likely keep inflated elevated.

Today is also the start of the seasonal Santa Rally 🎅 where low liquidity, low volume, and most market participants are on holidays. So I expect CTAs to send markets higher on this lower level of liquidity and volume next week. I want to see how price and flows react at SPX 3900.

I’ve initiated a few longs into TSLA 0.00%↑ ($120 was a key options level and it should get back to $136-140 as shorts cover and this is a heavily shorted stock), DIS 0.00%↑ , PYPL 0.00%↑ , etc. Until earnings recession materializes many companies are at oversold levels.

Although 4.7% is higher than 4.6%, the key is that PCE is below the Fed’s expectations—what matters is the Fed and what they are projecting and PCE came under their expectations (which is good for now).

Although PCE is below the Fed in-line projections, services inflation is still increasing MoM. Don’t expect a bull market out of this but it means more sideways action to burn both the bulls and bears.

Also people are yet again extrapolating that inflation is going to just roll over, yes it’s coming down because what the Fed is doing is working, but why do you think the Fed’s projections increased and they did not anticipate back in Sept FOMC to raise the terminal rate higher. These bulls are just begging for the Fed to prematurely ease or pivot or cut rates. The market leans bullish as we know markets are 70%+ in bull markets throughout history so it’ll just give more nice bear market rallies to then hedge into and swing the downside.

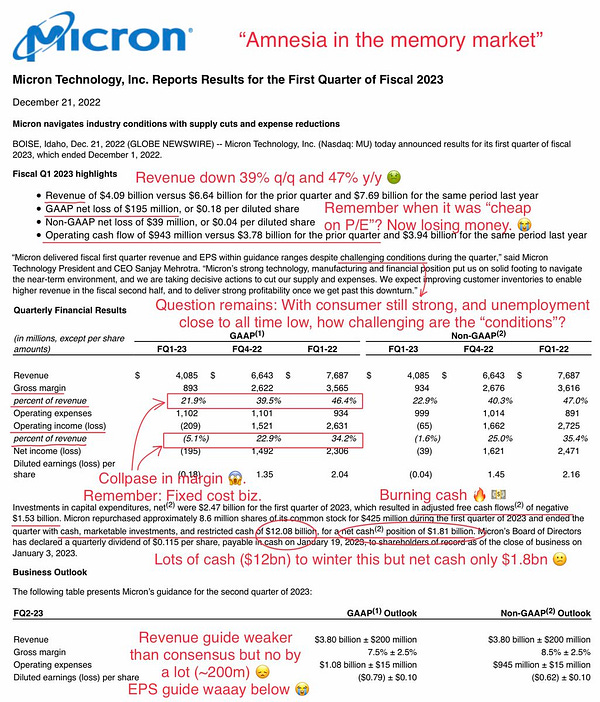

An earnings recession is not priced in and if many more companies report like Micron’s MU 0.00%↑ earnings, you bet we are going to make new lows in the market. The market is still trying to price in an optimistic soft landing and it won't just sell off rapidly down unless data/news/events warrant such panic selling.

Oil prices are rising again and with the economy seemingly looking like it can get a soft landing with all the spending, that’s going to be a problem for inflation if energy prices increase again. Although I exited OXY 0.00%↑ to manage risk, if it bounces off the daily MA200, I’ll go long it again as the chart looks constructive and I should’ve stuck to my thesis on energy.

Companies that are doing well

Companies like CAT 0.00%↑ (retesting ATHs) to J.M. Smucker Company SJM 0.00%↑ (made new ATHs). SJM 0.00%↑ makes peanut butter and jelly, pet food, coffee, fruit spreads, etc.—this is a reflection of the market we are in and how value is just outperforming tech. And isn’t it fair to say it’s value’s time? Value has been massively underperforming growth and tech for the past few decades. 😁

There are MANY stocks doing quite well in this market, so if you understood the macro and rotated with the market trend, you would be doing very well.

Wasteland Capital is an amazing follow on Twitter and he’s someone to follow who has called out the tech bubble awhile ago and rotated into companies that would benefit from this sea change—his portfolio is up around 40-70% YTD.

Here’s his awesome red pen analysis he does on many tech stocks and this is a recent one on MU 0.00%↑

Competition for Yields

This is why I don’t think we will enter any new bull market. I’m in the camp where this is a secular bear market with cyclical bull runs. Equities are going to have a hard time the next few years due to the higher cost of capital and how growth has to be EARNED now and it can no longer be bought with cheap capital.

Although I’ve been pretty bearish and right, I am an optimist. Short term there is still a possibility SPX can revisit 4300—it depends on next key economic reports and earnings next season. China is easing and supporting growth to avoid a recession and what if we get peace between Ukraine and Russia? That would ease pressure off energy inflation and countries are investing rapidly into non-fossil fuels (nuclear, etc.).

Longer term once price stability is achieved as well as years out, new innovations in AI will drive significant transformational change. Things like ChatGPT to the work being done on self-driving, 3D printing affordable homes, and so on is going to usher in a new bull market that will be a huge deflationary force but it’s going to take a lot of time for such a pivotal transition to take hold to the global masses.

Insightful Tweets

As forecasted more outflows from equities

Jan will be rough?

Market is sensitive to liquidity drains so I expect price action leading up to Jan 4th to be rough so any rallies will get faded as I have shared previously

This is short term bullish, I went long DIS 0.00%↑ for a swing after seeing this, as GDP up and inflation trending down is short term bullish until earnings recession materializes

We continue to trade sideways until more worst data comes out—the past 40 years has created one of the strongest economies ever so ~4% interest rates might not be enough to slow things down to “sufficiently restrictive” and why the Fed raised the terminal rate to over 5%

Agree, until majority of the permabulls turn into bears like that Tom Lee fellow, is when we are close to that max pain/capitulation. Many perma bulls already flipping bearish because they’d look quite dumb if they don’t face reality of the price action.

Ouch indeed 😢

*This is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.