TLDR;

Short-term: market will likely come down to retest SPX 3700, it might try to test 4050 or so again but interest rate sensitive sectors will continue to get pummeled while “old economy” companies will be where capital will flow to. Sectors and companies that would struggle in a higher interest rate and slower growth-recession-risk environment would be small caps, growth, real estate, etc. There is a potential bullish scenario where we can squeeze to 4300 (how CPI is calculated changes in Jan).

Long-term: I am bullish into 2023 if the Fed stays the tighter for longer course, read why below

Dec FOMC Meeting

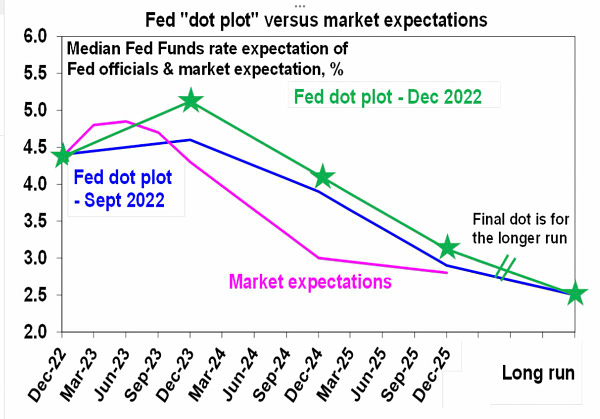

✅ Even higher terminal rate (SEP and dot plot projections) ← market did not price this in

✅ NO rate cuts in 2023—stay higher for longer ← market did not price this in

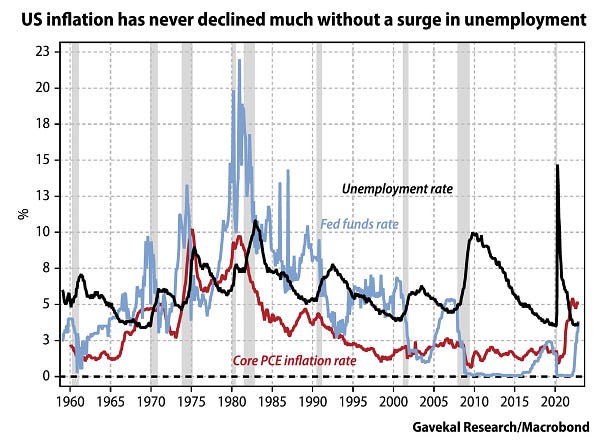

Although the market doesn’t believe the Fed, they will keep rates higher and stay tight for the rest of 2023. This has major implications on the higher cost of capital and hurdle rates for companies. It will lead to higher unemployment unfortunately as we are seeing layoffs in tech to media companies.

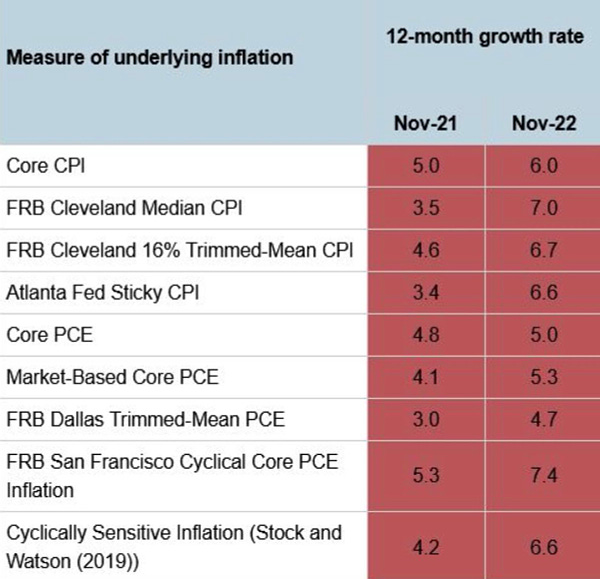

Let’s zoom out again and take a look at 12-month growth rate of inflation back in Nov 2021 vs Nov 2022 in the tweet below 👇 . As the Fed and I have said over and over again, inflation risks remain to the upside. Also notice Powell started his speech by addressing common Americans because inflation in food to housing is hurting them. The US is more a services economy vs a goods producing economy and wages will play a big role in sticky services inflation.

Once inflation gets going it is pernicious and HARD AS HELL to tame—it takes time and some economic pain to bring it back down. All these idiots want the Fed to ease soon, sorry but I don’t want high & variable inflation and rolling recessions.

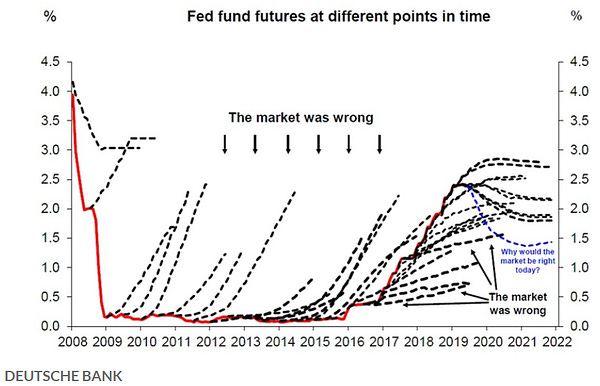

The market has been wrong about the Fed and the Fed Funds Rate many times before—and the market is slow to recognize a regime change.

A lot of media companies are laying off sizable % of their workforce

Howard Marks memo “Sea Change”

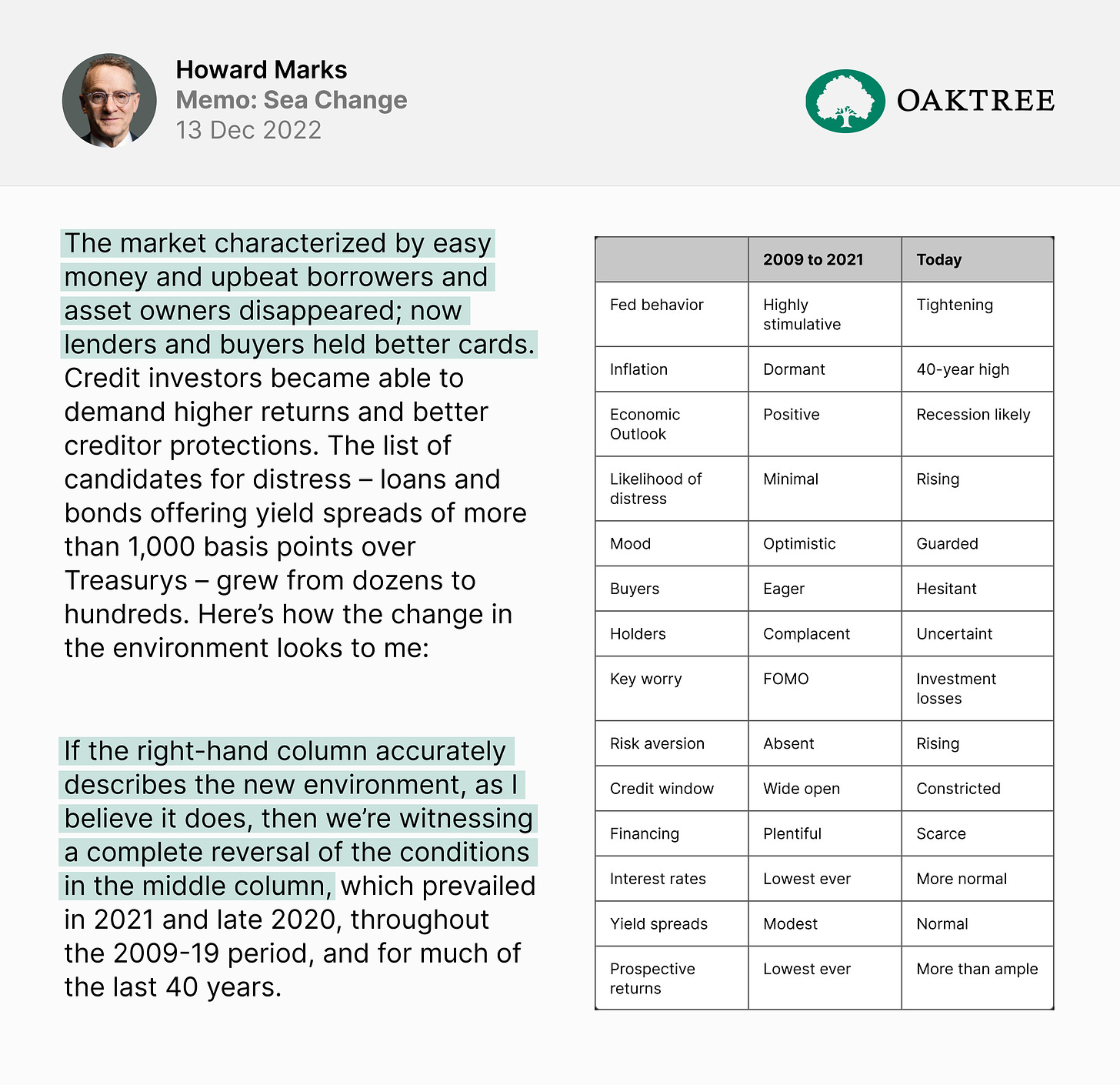

This is an amazing read and I suggest EVERYONE read it—Howard Marks is known to be a very micro and fundamental investor. He tells people that if the company’s story doesn’t change focus on the company and ignore the rest. But this Sea Change memo echoes what I have been warning readers of my Substack about—the market regime has changed.

What has worked for buy-and-hold investors the past ~40 years or so might not apply the next decade or so.

Here is what I mean by macro landscape has changed into a new market regime 👇

And why I have said before “micro will matter when macro stops mattering.” Until then, the macro is going to affect the micro and sectors. You will have to be an EXCELLENT stock picker to navigate this market.

My Thoughts—I’m Bullish for 2023 heading into 2024

The Fed is clearly committed to price stability and they do not plan to make a policy mistake to allow inflation to roar back. This is very bullish long-term (after all the FUD and slower growth fears are priced in). If prices are stable and comes down, companies can adjust and adapt their businesses to cut waste and inefficiencies, improve margins, increase productivity, etc. It will set up the economy for a nice rebound towards more productive use of capital and growth.

Think about all the investor capital destroyed in Nikola and all these joke zombie companies—QE infinity really distorted and misallocated capital. The price we pay for that is recession to correct this and reallocate capital towards real productive solutions and innovation that’ll drive real economic growth.

The higher interest rates will weed out crap companies and force companies to operate more effectively and efficiently. This is great for the economy long-term. And why going into 2023, any scary dips and panic sell offs, I will be a long-term buyer if the Fed stays their longer term tightening, price-stability policy.

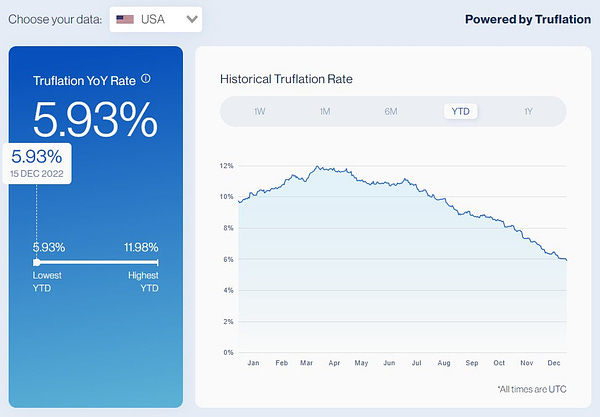

And it’s working as Truflation is reporting that inflation is abating <6% and we are making progress.

Today

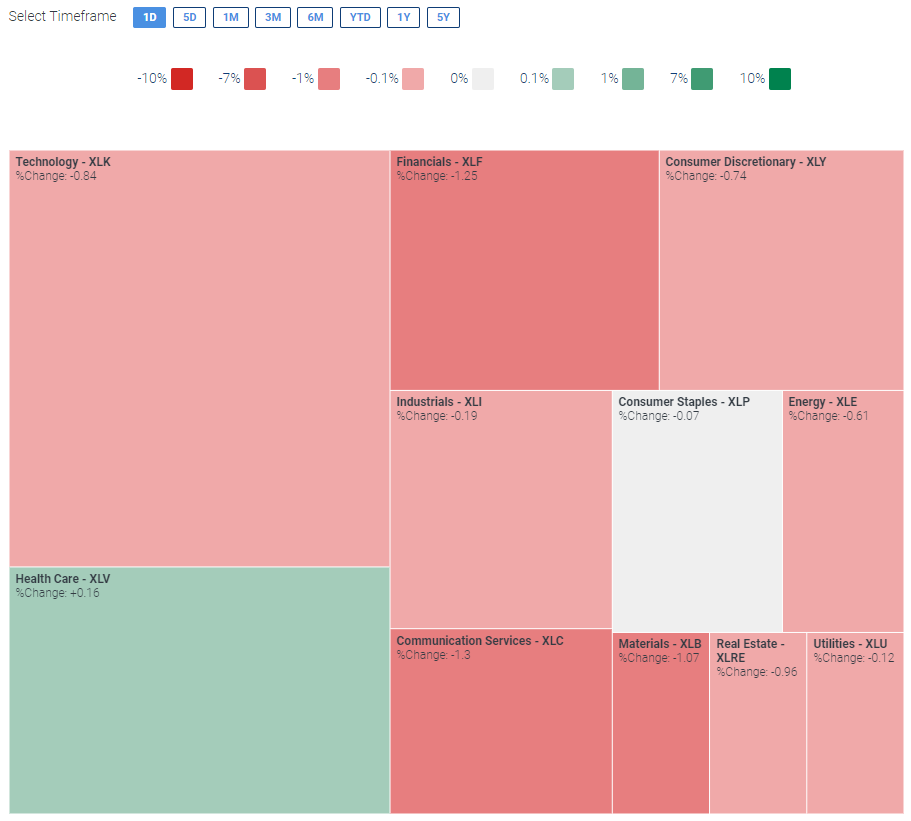

Which sectors fared better in today’s selling? The old economy sectors. Healthcare, as I have forecasted correctly and pointed out is growing since it’s the sector adding the most jobs, closed green today. And many healthcare companies continue to make new 52 week highs. Consumer Staples also held up pretty well, companies like General Mills GIS 0.00%↑ , Campbell Soup CPB 0.00%↑ , Conagra Brands CAG 0.00%↑ made new 52 week highs.

Held up reasonably well: Healthcare, Consumer Staples, Industrials, Utilities, Energy

Did not hold up as well: Communication Services, Financials, Materials, Real Estate, Technology, Consumer Discretionary

What’s the difference? Healthcare, Consumer Staples, Energy, etc. are necessities, cash will continue flowing into those companies in a higher interest rate environment.

While media companies, tech, banks, real estate, consumer discretionary, etc. aren’t going to do as well. Because they are more interest rate sensitive and are not necessities or involve more risks if economy slows down dramatically (banks and loan defaults).

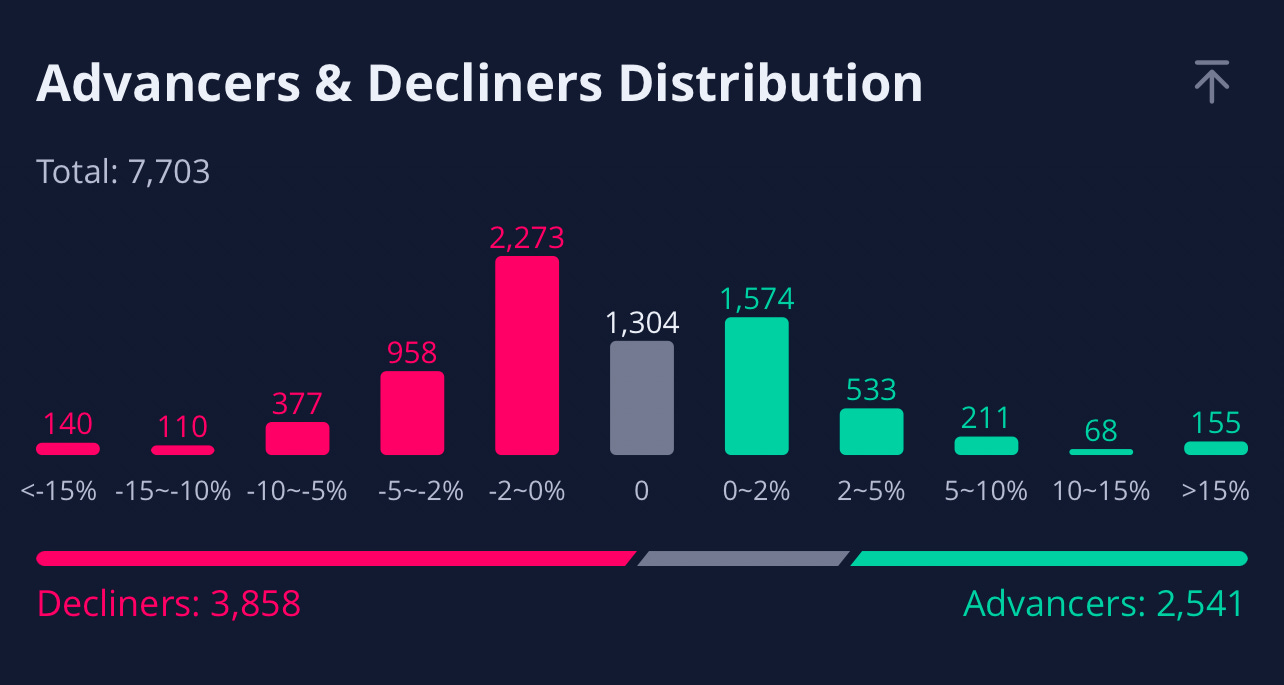

Surprisingly the market didn’t completely sell off today. This has been quite interesting price action. The cooler than expected CPI didn’t send the market up and breakout above 4100 and this more hawkish than expected FOMC didn’t send the market down and break down below 3900.

Nasdaq saw 249 new 52-week lows vs 113 new 52-week highs.

NYSE saw 92 new 52-week lows vs 47 new 52-week highs.

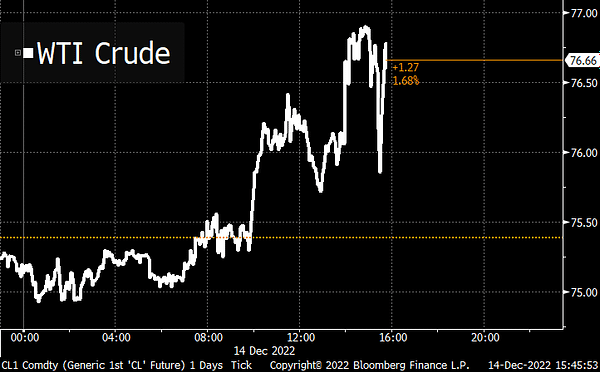

Oil was Interesting

It is up for the week and this big increase in crude oil inventory, interesting enough, didn't send oil down dramatically.

But the rebound in price is also interesting—WTI Crude oil prices are still positive and going higher $76+ and also, Biden created a floor as SPR will buy oil at $75 😁

With China reopening and funding consumption, demand for oil should increase

This is probably why Chinese stocks hit 52-week highs, especially the retail ones like PDD 0.00%↑ and this also is quite bullish for future oil demand. I think the Chinese government is trying to avoid a recession by spurring demand and economic activity.

Insightful Tweets

As I accurately pointed out in my forecast leading up to FOMC and as Powell aptly stated “wages running well above what’s consistent with 2% inflation.”

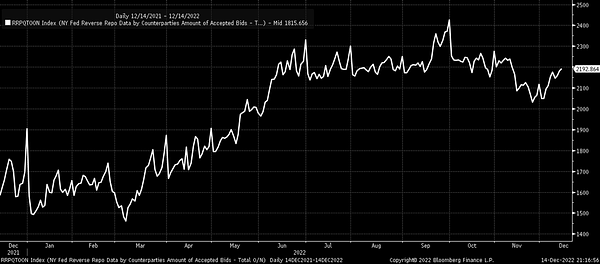

When repos increase it means capital (liquidity) is being sucked out of the markets and parked into repo for its risk-free rate of return

Yup, we need a lot more progress on core inflation

Interesting tweet—I hope we get a soft landing but we will have to see

*This is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.