Have been out for Thanksgiving, Tea Ceremony, and legal wedding ceremony!

Recap

✅ If you review the past months of posts, a lot of my forecasts have now come true:

AI bubble continues getting bigger ✅

The November jobs report would turn up ✅ This ended up being even more bullish than I forecasted!

From Nov 4 Substack post: Underlying Labor Market Remains Stable VIX fell back to 12 and we hit SPX 6000 ✅ (which has been a forecast I shared would happen months ago) and the LEI indeed is lagging in this Golden Path scenario we are in.

From Oct 20 Substack Post: The Leading Economic Indicator a "Lagging" Indicator in Golden Path 🎅 Santa Claus Rally with IWM making new all-time highs ✅

Below are the headlines and sub-headlines for my previous posts where I’ve maintained my bullish forecast and call each dip as opportunities.

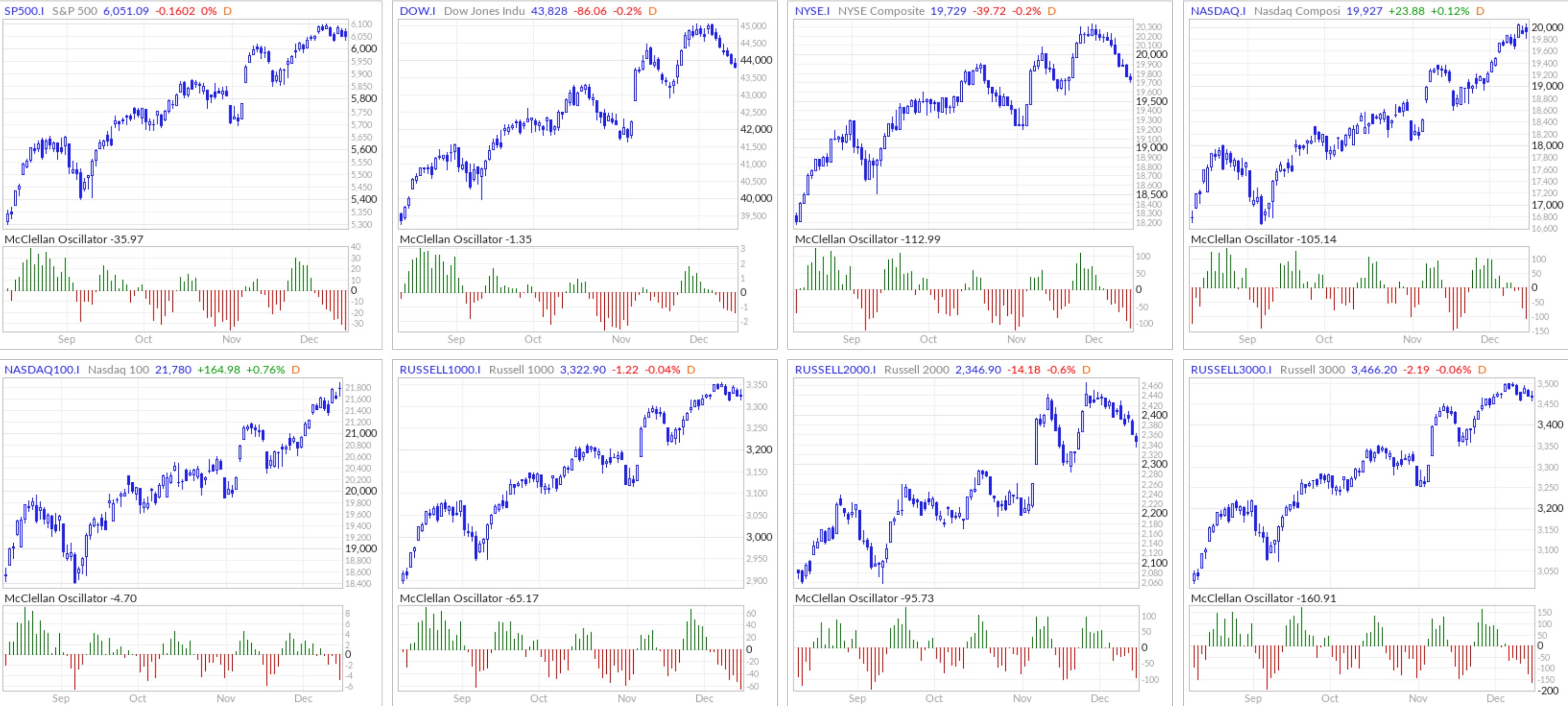

New 52-Week Highs vs New 52-Week Lows

NYSE New 52-Week Highs: 40 vs New 52-Week Lows: 113

Nasdaq New 52-Week Highs: 131 vs New 52-Week Lows: 225

McClellan Oscillator

Reading is at levels where a bounce is upcoming.

New Highs - New Lows

NYSE made a new lows on the chart and a lot of the indices are at 0 or lower reading, which is an area that tends to bounce.

*This my personal blog and is not investment advice—I am not a financial advisor but a random person on the internet who does not have a license in finance or securities. This is my personal Substack which consists of opinions and/or general information. I may or may not have positions in any of the stocks mentioned. Don’t listen to anyone online without evaluating and understanding the risks involved and understand that you are responsible for making your own investment decisions.

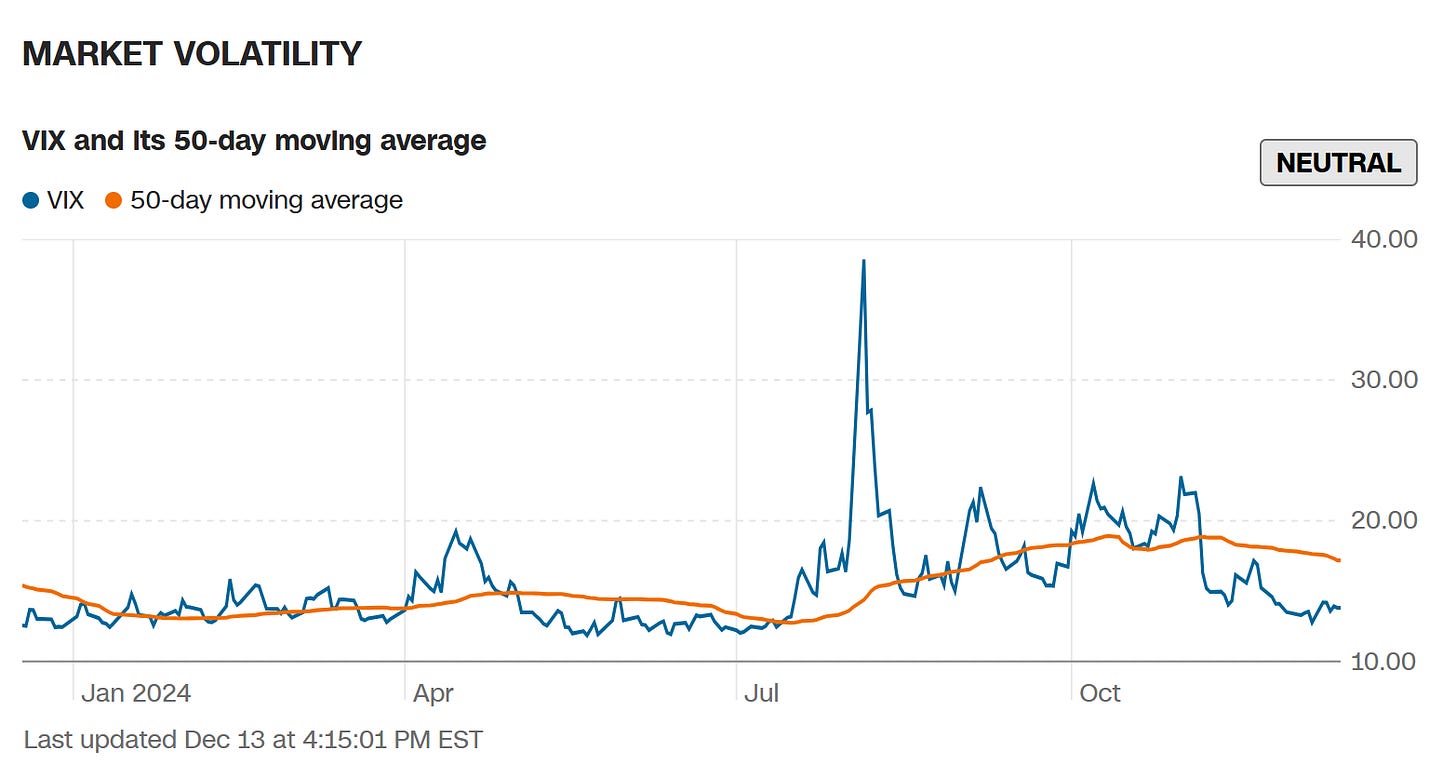

VIX is signaling relative stability

The combination of declining interest rates, strong jobs growth, “Age of AI” driving innovation and productivity, and subdued inflation, the market appears poised for a period of relative stability.

1. Falling Interest Rates and Corporate Taxes

As central banks are expected to ease monetary policy further the lower interest rates will reduce the cost of capital in addition to Trump Administration promising to reduce the corporate tax rates to 15%. This environment supports corporate profitability and encourages equity investments. Historically, periods of declining or low interest rates have correlated with a subdued VIX.

2. Robust Jobs Growth and Strong Economic Fundamentals

The robust jobs growth continues to support consumer spending as evidence by record Black Friday which set new records in online sales, with U.S. consumers spending approximately $10.8 billion, marking a 10.2% increase from the previous year. This surge was driven by several factors:

Mobile Shopping: Over 55% of online purchases were made via mobile devices, highlighting the growing preference for shopping on-the-go. ABC News

Generative AI Assistance: The use of AI-powered chatbots increased by 1,800%, enhancing customer experience and contributing to higher conversion rates. Barron's

Attractive Discounts (falling inflation): Significant price reductions, especially in categories like toys (over 27% off), electronics, and apparel, enticed consumers to spend more.

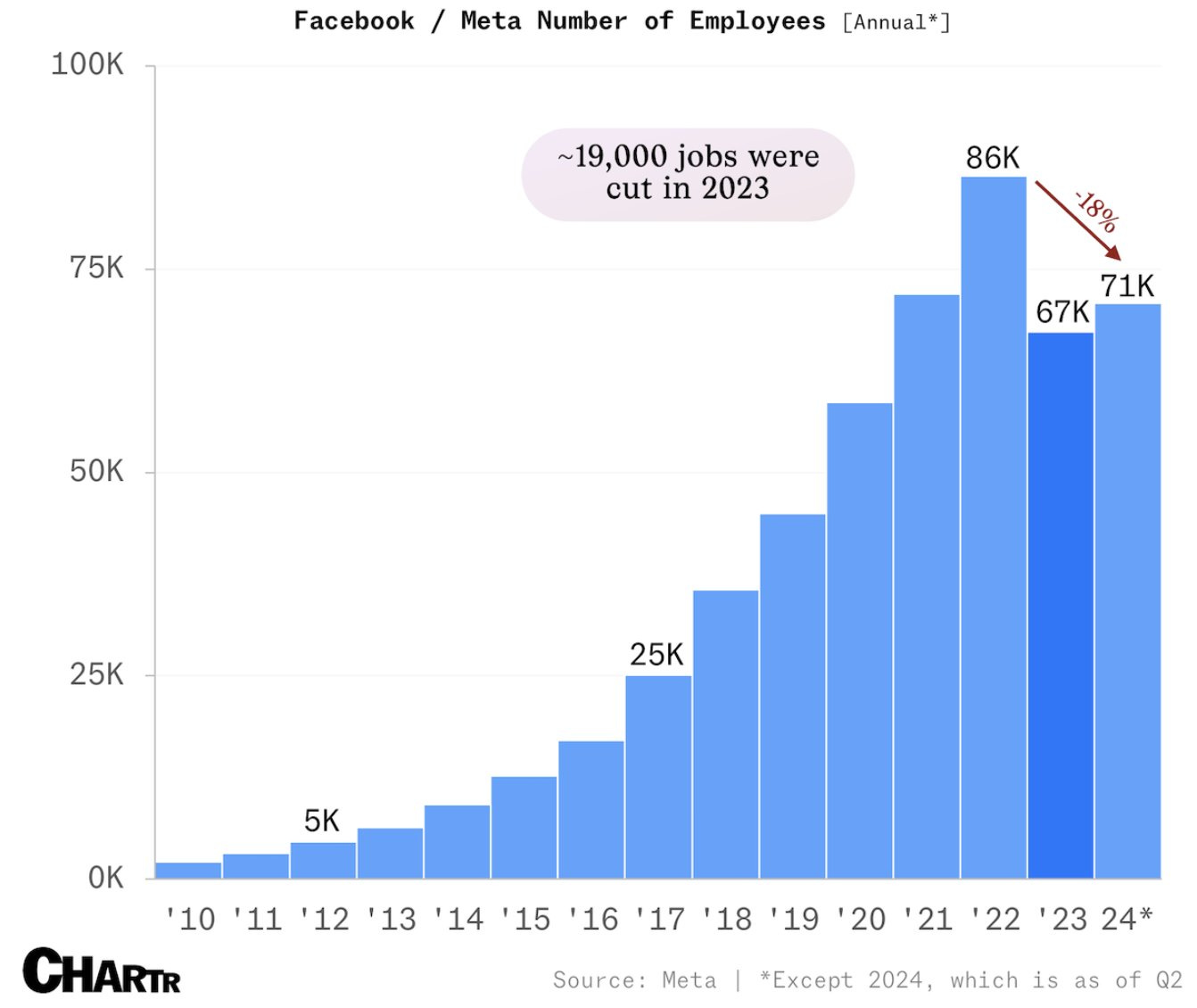

3. AI-Driven Innovation

Based on Black Friday sales, artificial intelligence is rapidly transforming industries, enhancing productivity (Facebook or META has less employees while continuing to grow revenue), and creating new growth opportunities. The innovation driven by AI not only raises earnings potential but also increases confidence in future growth.

2025 Forecasts

Keep reading with a 7-day free trial

Subscribe to Best of Twitter/Threads, Analysis & Forecasts to keep reading this post and get 7 days of free access to the full post archives.